A significant development has unfolded in the cryptocurrency sector as a US federal court has placed a temporary freeze on approximately $57.65 million worth of the stablecoin USDC in connection with a class action lawsuit surrounding the controversial Libra memecoin. The order, enacted on May 28, came at the request of Burwick Law, representing plaintiffs including Omar Hurlock. The case centers on allegations that Kelsier Ventures, along with its co-founders, misled investors and siphoned off over $100 million through liquidity pools tied to the Libra cryptocurrency.

The class action suit has also named several blockchain infrastructure companies and their leaders as defendants. A court hearing is set for June 9, where the future of the frozen assets will be determined as the legal proceedings continue. The freezing of these funds was executed through two Solana wallets, with a large portion being held at Circle, illustrating the serious nature of the ongoing litigation.

“Yesterday, a federal court in SDNY entered a Temporary Restraining Order at our request,” said Max Burwick, the class group’s lawyer, highlighting the ongoing legal actions against those implicated in the scandal.

Notably, the Libra token initially surged to a $4 billion market cap following a social media post from Argentine President Javier Milei, only to experience a drastic 94% crash shortly thereafter. This dramatic fallout raised political tensions in Argentina, leading to calls for impeachment from opposition members, although such efforts have seen limited success.

In a related twist, President Milei has since closed a task force that was investigating the Libra situation, leaving many critics questioning the integrity of the investigation. Despite the political furor and legal complexities surrounding this case, no substantial actions have been taken against Milei or other officials linked to the matter, prompting accusations of a cover-up by those involved.

As the legal landscape continues to develop, this case serves as a stark reminder of the risks and controversies associated with emerging cryptocurrencies and the ongoing scrutiny faced by industry participants.

USDC Frozen in Class Action Case Over Libra Memecoin

The recent legal developments involving the freezing of USDC are significant for both the cryptocurrency market and investors. Here are the key points:

- Federal Court Action:

- A US federal court has frozen approximately $57.65 million worth of the stablecoin USDC.

- The freeze was enacted as part of a class action lawsuit concerning the Libra memecoin.

- Class Action Lawsuit:

- The lawsuit is led by attorney Max Burwick representing Omar Hurlock and others against Kelsier Ventures and its founders.

- Claims include allegations of misrepresentation and siphoning over $100 million from liquidity pools.

- Impact on Investors:

- Approximately $57 million held at Circle was frozen pending a court hearing on asset status.

- This legal action may lead to greater scrutiny of digital assets and their management.

- Political Implications:

- The Libra scandal has negatively affected Argentine President Javier Milei’s political standing.

- Concerns have been raised over the legitimacy of investigations related to the scandal.

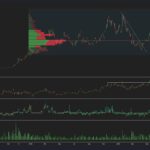

- Market Reaction:

- LIBRA’s market cap reached $4 billion before dramatically crashing, which has altered market perceptions.

- The fallout may discourage future investments in memecoins and riskier crypto projects.

Legal outcomes such as these will shape not only regulatory frameworks but also influence investor confidence in the cryptocurrency market.

Legal Turmoil Surrounds USDC in Libra Controversy

The recent decision by a US federal court to freeze approximately $57.65 million worth of USDC amid ongoing litigation surrounding the Libra memecoin has ignited a firestorm in the cryptocurrency sector. This situation mirrors other high-profile cases where stablecoins and digital assets encountered regulatory scrutiny, yet what sets this incident apart is the involvement of a controversial cryptocurrency tied to a political figure. In contrast to typical crypto class actions that focus on fraud or misrepresentation, this case emphasizes a complex interplay of investor trust and regulatory oversight, particularly given the political fallout from the events in Argentina.

Competitive Advantages: The primary advantage for plaintiffs is the court’s proactive stance in issuing a Temporary Restraining Order. This order serves to safeguard investor assets while the lawsuit unfolds, emphasizing the judiciary’s commitment to consumer protection in the rapidly evolving crypto landscape. Additionally, the publicity surrounding the freeze could deter potential investors from engaging with Kelsier Ventures, thereby reducing the company’s ability to manipulate liquidity pools further.

On the flip side, the defendants, including Kelsier Ventures and its associated founders, possess a potential edge via their capability to challenge the extent of the SEC’s jurisdiction and assert that the regulations around memecoins and stablecoins are still nebulous. This ambiguity may create room for them to argue for the reinstatement of their assets, especially if they can showcase weaknesses in the plaintiffs’ case.

Beneficiaries and Potential Problems: While this legal action could bolster confidence among investors wary of unstable assets, it simultaneously poses significant risks for Kelsier Ventures and its co-founders. If the court upholds the freeze, it could validate claims against them, leading to loss of reputation and market trust. Additionally, Argentine political figures, like President Javier Milei, may face increased scrutiny and backlash, jeopardizing their political standing in light of recent scandals. Stakeholders in associated blockchain companies, like KIP Protocol and their CEO, may also find themselves caught in the crossfire of reputational damage and regulatory challenges as the fallout continues.