In a pivotal shift for the cryptocurrency landscape, new regulatory guidance from the US Office of the Comptroller of the Currency (OCC) now permits banks to serve as validators in blockchain networks. This development, highlighted by Bohdan Opryshko, the chief operating officer of staking service provider Everstake, signals a significant move towards broader institutional adoption but also raises concerns about potential centralization risks in proof-of-stake (PoS) networks.

On March 7, the OCC announced that it was easing restrictions on how banks can engage with the cryptocurrency market, specifically allowing them to participate in “independent node verification networks.” Opryshko explained that while increased bank participation in PoS platforms such as Ethereum and Solana might drive investments and enhance stability, it could also lead to a concentration of power among a few dominant validators. This could threaten the decentralized ethos that many blockchain advocates hold dear.

“If banks become dominant validators, power could become concentrated, reducing the decentralized nature of PoS networks,” Opryshko remarked in an interview with Cointelegraph on March 12.

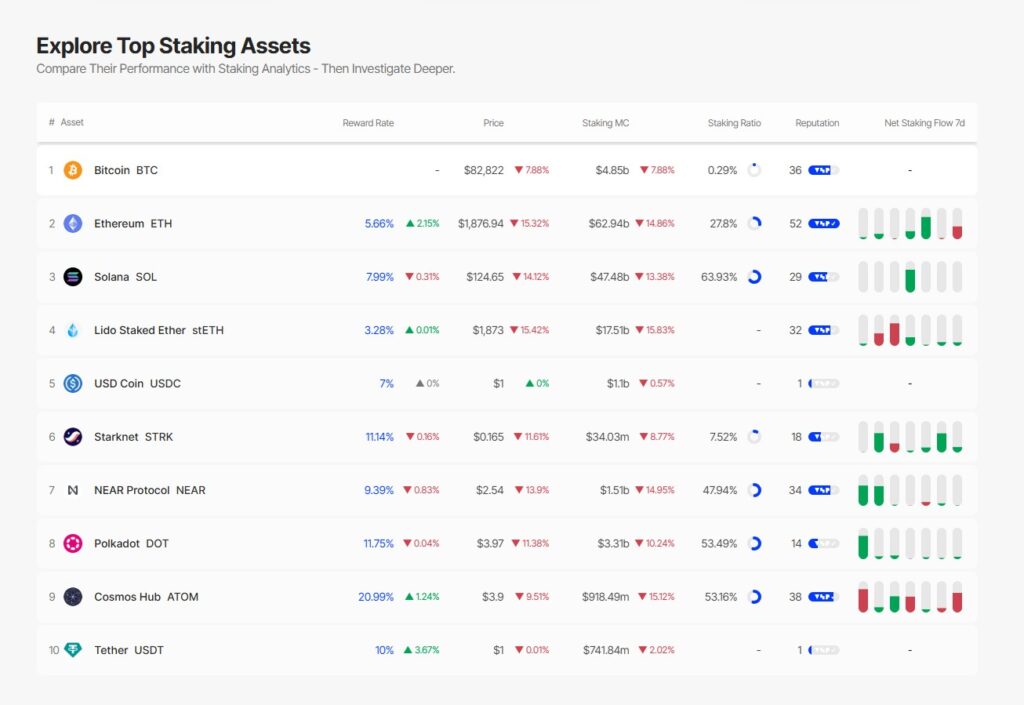

The influx of institutional capital into staking could inadvertently lead to diminished staking rewards for smaller validators. According to Opryshko, the entry of major players with substantial stakes could drastically lower the staking yields, thus impacting all other participants in these networks. As of mid-March, staking rewards stand at approximately 5.5% APR for Ethereum and nearly 8% for Solana, as noted by data from Staking Rewards.

This regulatory shift has sparked a broader conversation in the crypto community, especially in light of past tensions surrounding the “debanking” issue, where crypto firms faced challenges accessing traditional banking services. The outrage reached a peak following a lawsuit led by Coinbase, which revealed efforts by US regulators to curtail crypto banking activities.

Notably, this new regulatory environment comes on the heels of a Jan. 23 executive order from President Trump, who articulated a vision of making the US the “world’s crypto capital” and called for fair access to banking services for digital asset firms. As it stands, Anchorage Digital remains the only federally chartered bank in the US to offer cryptocurrency staking, marking an interesting phase ahead for financial institutions venturing into the cryptocurrency space.

US Regulatory Guidance and Its Impact on Cryptocurrency Adoption

The recent changes in US regulatory guidance allowing banks to act as validators for blockchain networks present both opportunities and challenges for the cryptocurrency ecosystem. Here are the key points to consider:

- Regulatory Change by OCC:

- The US Office of the Comptroller of the Currency (OCC) has eased its regulations on banks engaging with cryptocurrency.

- Banks are now permitted to participate in independent node verification networks.

- Potential for Institutional Adoption:

- This marks a significant step towards institutional adoption of blockchain technology.

- Increased participation from banks can lead to more robust financial support for blockchain projects.

- Centralization Risks:

- Increased involvement of banks in proof-of-stake (PoS) networks may lead to concentration of power among a few dominant validators.

- This could undermine the decentralized nature that PoS networks are designed to promote.

- Impact on Staking Yields:

- Major institutional players entering the staking market may depress staking yields.

- As banks stake large amounts, it could cause a sharp reduction in rewards for smaller validators, potentially threatening their viability.

- Current Staking Yields:

- As of March 12, Ethereum stakers earn approximately 5.5% APR, while Solana stakers earn about 8%.

- Context of Regulatory Environment:

- The OCC’s decision follows backlash against “debanking,” where crypto firms faced restricted access to banking services.

- Former President Donald Trump promised to ensure fair access to banking for digital asset firms.

- Current Market Position:

- As of March 12, Anchorage Digital is the only federally chartered US bank providing cryptocurrency staking services.

“If banks become dominant validators, power could become concentrated, reducing the decentralized nature of PoS networks.” – Bohdan Opryshko, COO of Everstake

US Regulatory Guidance: A Game Changer for Institutional Crypto Adoption

The recent move by the US Office of the Comptroller of the Currency (OCC) to permit banks to act as validators in blockchain networks signals a transformative era for institutional cryptocurrency adoption. However, while this shift opens doors for financial institutions to integrate into the crypto ecosystem, it also raises pressing concerns regarding centralization and market equity. Experts like Bohdan Opryshko from Everstake have highlighted these critical aspects of this new regulatory landscape.

On one hand, the entry of banks as validators could lead to substantial investment flows into proof-of-stake (PoS) networks such as Ethereum and Solana. This influx could enhance network security and liquidity, benefiting users by providing more robust staking opportunities and potentially driving innovation in blockchain technology. However, the downside is significant. With institutions staking large amounts, there’s a risk that smaller validators could be edged out due to diminished staking rewards, thereby undermining the very essence of decentralization that attracted many to blockchain technology in the first place.

Importantly, this regulatory shift could significantly impact various stakeholders in the crypto space. Institutional players, including banks and major financial firms, stand to gain from enhanced legitimacy and larger market share in staking. Conversely, smaller validators and individual investors could find themselves facing reduced incentives to participate in these networks. This dynamic puts emerging validators at a disadvantage, potentially creating a market that favors larger entities, ultimately leading to a concentrated power structure within the blockchain environment.

The current climate has also seen mixed reactions from crypto enthusiasts and investors, particularly those who harbor concerns about the integrity of decentralized finance. With the OCC’s easing of restrictions coming on the heels of a regulatory crackdown that has sparked a broader debate about access to banking services for crypto firms, this new guidance could be perceived as both an opportunity and a threat. The healthy competition intended in decentralized networks may be compromised if a handful of institutions dominate the staking scene.

Ultimately, while the OCC’s guidance can spark broader acceptance and integration of cryptocurrencies in traditional finance, it creates a dichotomy between facilitating innovation and preserving the foundational values of decentralization. Stakeholders need to consider these implications carefully as they navigate their positions within this evolving landscape.