In a notable development in the cryptocurrency landscape, global investment manager VanEck has officially filed for an Avalanche (AVAX) exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC). This filing represents a significant step in providing investors with direct exposure to the Avalanche smart contract platform, which is gaining recognition for its speed and efficiency within the blockchain space.

“The proposed VanEck Avalanche ETF intends to reflect the performance of the price of AVAX, the native token of the Avalanche network, less the expenses of the Trust’s operations,”

According to a snippet of the filing shared by Bloomberg analyst James Seyffart, the fund aims to hold AVAX tokens and will value its shares daily based on an established market benchmark. This move is particularly remarkable as it is the first actual application of its kind submitted to the SEC for Avalanche, despite prior interest in crypto ETFs.

As the 16th largest cryptocurrency, with a market capitalization of .7 billion, Avalanche is noted for its high throughput and compatibility with the Ethereum Virtual Machine. The momentum behind crypto ETFs is growing, following the success of U.S. spot Bitcoin ETFs and a favorable regulatory climate under a pro-crypto administration. This climate has spurred a wave of applications for various crypto ETFs at the SEC, including those linked to popular assets like XRP, Solana (SOL), Litecoin (LTC), and Dogecoin (DOGE).

“Analysts predict a relatively high likelihood of approval for these offerings later this year,”

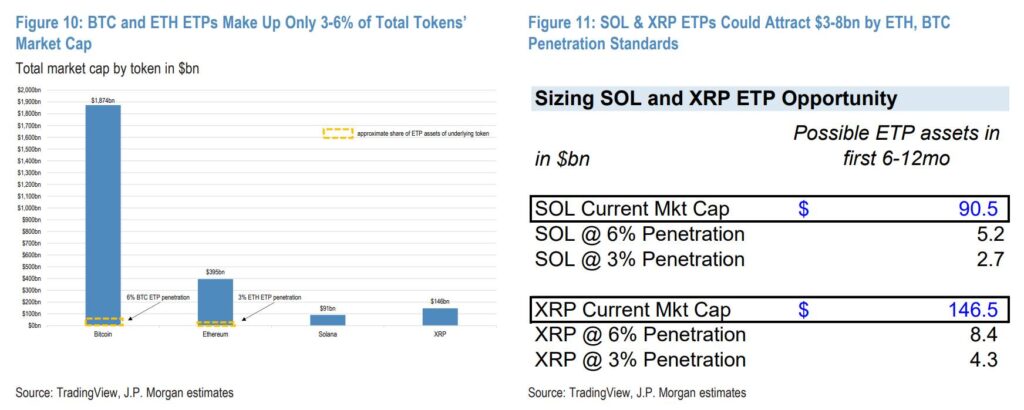

As reported by Cointelegraph, although the SEC has extended its review periods for these filings, analysts Seyffart and Eric Balchinas maintain an optimistic outlook regarding potential approvals. A recent analysis from JPMorgan projects that the approval of altcoin ETFs could lead to billions in inflows, citing strong demand from institutional investors, particularly for SOL and XRP products, which could attract substantial net assets in their initial year.

This surge of interest from investment managers showcases the expanding appetite for cryptocurrency-related financial products and highlights the evolving landscape of digital asset investments.

VanEck Files for Avalanche ETF: Implications for Investors

The recent filing by VanEck for an Avalanche (AVAX) exchange-traded fund (ETF) could signify pivotal changes in the cryptocurrency investment landscape.

- Direct Exposure to AVAX:

The VanEck Avalanche ETF aims to provide investors with direct exposure to AVAX, enhancing portfolio diversification.

- Performance Tracking:

The fund intends to reflect the performance of AVAX’s price, potentially making it easier for investors to participate in Avalanche’s market movements.

- Growing Popularity of Crypto ETFs:

The increase in filings for crypto ETFs, including those for XRP, Solana, and others, suggests a growing acceptance of cryptocurrencies in traditional finance.

- Institutional Interest:

Reports indicate that approval of altcoin ETFs could trigger billions in institutional investments, benefiting the wider crypto market.

- Potential Market Impact:

As noted by JPMorgan, successful adoption rates for altcoin ETFs could result in substantial inflows, particularly for Solana and XRP.

- Broader Economic Climate:

The pro-crypto stance of the current US administration may provide a favorable environment for ETF approvals, impacting the overall investor sentiment towards crypto assets.

“The overwhelming success of the US spot Bitcoin ETFs has triggered an influx of crypto fund applications at the SEC.” – James Seyffart

VanEck’s Avalanche ETF: A New Contender in the Crypto ETF Landscape

In a strategic move indicative of the burgeoning cryptocurrency investment landscape, VanEck has recently submitted an application for an Avalanche (AVAX) exchange-traded fund (ETF) to the US Securities and Exchange Commission (SEC). This proactive step positions VanEck among an increasing number of financial institutions eager to capitalize on the rising popularity of cryptocurrency assets. Notably, Avalanche ranks as the 16th largest cryptocurrency by market capitalization, boasting a robust platform known for its high throughput and compatibility with the Ethereum Virtual Machine (EVM).

VanEck’s proposed ETF aims to mirror the performance of the AVAX token, providing a straightforward pathway for investors to gain exposure to this innovative blockchain ecosystem. This strategy stands out compared to other recent ETF developments in the market, particularly those focused on well-established cryptocurrencies like Bitcoin and Ethereum. The anticipation surrounding the approval of multiple altcoin ETFs indicates a significant shift towards facilitating greater access and institutional investment in various crypto assets.

Competitive Advantages

One of the main competitive advantages of the VanEck Avalanche ETF is its potential to attract a niche segment of investors eager to diversify their portfolios beyond Bitcoin and Ethereum. The underlying technology of Avalanche, coupled with its high performance and growing market appeal, positions the ETF to cater to both institutional and retail investors interested in tapping into innovative blockchain applications. Furthermore, the current upward momentum in ETF filings is driven by a pro-crypto climate in Washington, fostering optimism for favorable SEC decisions.

Challenges and Considerations

However, the proposed VanEck ETF enters a highly competitive environment, where multiple issuers are simultaneously vying for approval of altcoin ETFs, including those tied to XRP, Solana, Litecoin, and Dogecoin. The SEC’s tendency to prolong its review processes poses a significant hurdle; thus, while there is speculation about a higher likelihood of some ETF approvals later this year, it’s crucial to note that not all proposals may succeed. Additionally, VanEck will need to establish trust and awareness among potential investors to distinguish its product in a crowded marketplace.

This move could significantly benefit retail investors seeking accessible ways to invest in the rapidly evolving blockchain space, as well as institutional players looking to diversify their crypto portfolios. However, should the SEC’s decisions favor more established projects or larger crypto assets over newer entrants like Avalanche, the market might face a setback, challenging VanEck’s strategic positioning. The success of this ETF could ultimately hinge not just on regulatory aspects, but also on broader market sentiments and the adoption of new blockchain technologies.