In an exciting development for the finance world, investment firm VanEck is set to launch a groundbreaking tokenized fund that will provide investors with exposure to U.S. Treasury bills. This innovative initiative, known as the VBILL fund, is a collaboration with Securitize, a leader in the tokenization space. By stepping into the realm of real-world asset (RWA) tokenization, VanEck joins a rising tide of traditional finance firms eager to embrace the digital transformation of financial assets.

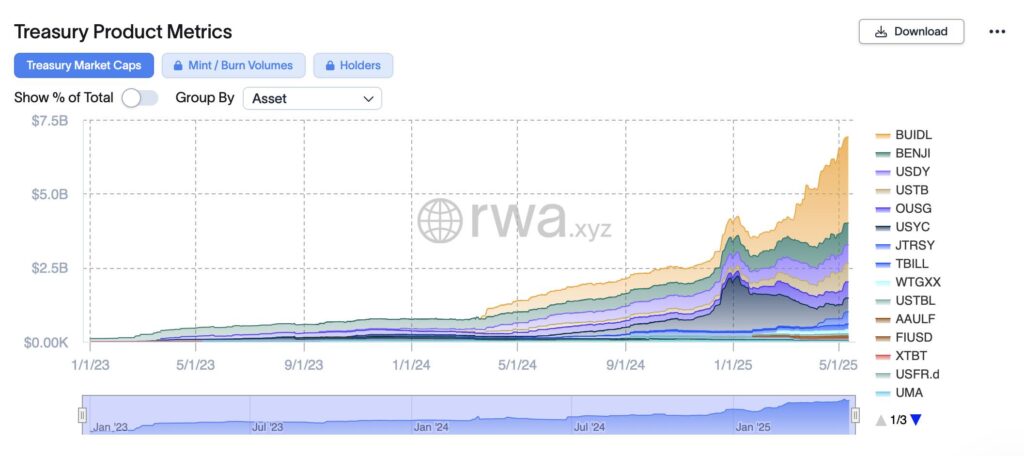

The VBILL fund is making waves by offering a minimum investment of $100,000 on popular blockchain platforms like Avalanche, BNB Chain, and Solana, while the entry point for Ethereum investors climbs to $1 million. This broad accessibility highlights a strategic move to tap into the burgeoning market of tokenized real-world assets, which, according to RWA.xyz, has seen rapid growth with a market cap of $6.9 billion, making U.S. Treasuries one of the largest asset classes in this domain.

“Faster settlement times and improved liquidity are among the benefits that advocates highlight for tokenized assets,”

VanEck isn’t alone in this venture; it faces competition from heavyweights like BlackRock and Franklin Templeton, who have also ventured into RWA tokenization. For example, Apollo, a formidable player that oversees approximately $751 billion in assets, launched its own tokenized fund earlier this year. These firms recognize the potential of tokenization to revolutionize how assets are managed and traded, offering faster settlement times and bringing liquidity to assets that were previously considered illiquid.

Adding to the conversation, SEC Chair Paul Atkins recently likened the move towards on-chain securities to the seismic shift from analog to digital audio in the music industry. His remarks at a recent SEC roundtable underscored the transformative potential of blockchain technology in redefining market dynamics and unlocking new avenues for trading and investing.

As companies like Securitize continue their work in tokenizing substantial assets—over $3.9 billion to date—the financial landscape seems poised for an evolution, blending traditional finance with the innovative capabilities of blockchain technology. With the launch of the VBILL fund, VanEck is not only making an impactful statement but also positioning itself at the forefront of this financial revolution.

VanEck’s Tokenized RWA Fund: Key Insights

VanEck is making significant strides in the investment landscape with its new tokenized real-world asset (RWA) fund. Here are the key points to consider:

- Fund Overview:

- Launched by VanEck in partnership with Securitize.

- Focuses on US Treasury bills.

- Blockchain Platforms:

- Available on multiple blockchains: Avalanche, BNB Chain, Ethereum, and Solana.

- Enhances accessibility to a wider range of investors.

- Investment Minimums:

- $100,000 minimum for Avalanche, BNB Chain, and Solana.

- $1 million minimum for Ethereum investments.

- Market Context:

- VanEck joins a competitive sector with firms like BlackRock and Franklin Templeton.

- Increased institutional interest in RWA tokenization is noted.

- Tokenization Benefits:

- Faster settlement times compared to traditional finance systems.

- Increased liquidity for previously illiquid assets.

- Technological Shift:

- SEC Chair Paul Atkins highlights the transformative potential of blockchain technology.

- Comparison made to the transition from analog to digital music, indicating a seismic shift in securities trading.

“Blockchain technology holds the promise to allow for a broad swath of novel use cases for securities, fostering new kinds of market activities.” – SEC Chair Paul Atkins

Understanding the implications of tokenized real-world assets can impact personal investment strategies, especially for those considering participation in emerging financial technologies.

VanEck’s Tokenized RWA Fund: A New Contender in the Digital Asset Space

VanEck’s recent introduction of its tokenized real-world asset (RWA) fund, VBILL, solidifies its position within the rapidly evolving landscape of digital asset investment. This initiative is not occurring in a vacuum; rather, it’s part of a broader trend where established financial entities like BlackRock and Franklin Templeton are entering the tokenization arena. By partnering with Securitize, a leader in asset tokenization, VanEck not only leverages technological expertise but also aligns itself with innovations that are poised to reshape traditional finance.

One of the significant advantages of VanEck’s fund is its accessibility across multiple blockchain platforms, including Avalanche, BNB Chain, Ethereum, and Solana. This multi-chain approach differentiates it from some competitors that are focused on a single blockchain, potentially appealing to a wider range of investors. Additionally, the minimum investment thresholds, while on the higher side, could attract institutional investors who are more accustomed to such capital commitments in the realm of US Treasury bills. However, this exclusivity might turn away smaller investors who seek lower entry points.

Despite these advantages, VanEck faces stiff competition from industry giants like BlackRock, which has already established a significant foothold in the RWA tokenization space. BlackRock’s extensive resources and marketing prowess may overshadow VanEck’s efforts in attracting attention. Thus, while VanEck’s initiative is promising, the road ahead includes navigating the intense rivalry and proving its unique value proposition in a crowded market.

Moreover, with SEC Chair Paul Atkins pointing towards the potential transformation blockchain could have on securities, regulatory scrutiny remains a double-edged sword for firms like VanEck. On one hand, the support of regulatory bodies can bolster investor confidence, yet on the other, stringent regulations could stifle innovation. For existing traditional finance players, this paradigm shift offers both opportunities to innovate and the challenges of adapting to rapid changes that past regulations might not accommodate.

Investors and asset managers will need to stay vigilant as the tokenized RWA market matures. While funds like VBILL offer a glimpse into the future of asset management, they also highlight potential pitfalls for those unprepared to pivot. As the landscape shifts, those who can adapt to these new technologies and regulations will likely emerge as leaders, while others may find themselves trailing behind in the digital currency race.