In a notable development within the cryptocurrency landscape, global investment firm VanEck has officially registered the VanEck Avalanche ETF in Delaware. This move signals a potential filing for a spot Avalanche (AVAX) ETF in the United States, illustrating VanEck’s ongoing commitment to diversifying its cryptocurrency investment products. Public records reveal that this new ETF is set to join the ranks of other significant registrations by VanEck, which has already established standalone ETFs for Bitcoin, Ether, and Solana.

The timing of the VanEck Avalanche ETF registration is particularly intriguing, coming amidst considerable turbulence in the crypto market. As reported by CoinGecko, Avalanche’s price has plummeted 55% year-to-date, with Bitcoin also experiencing a decline of around 17% so far in 2025. Despite these market challenges, the introduction of new ETFs highlights a persistent interest and investment strategy within the cryptocurrency sector.

“Avalanche’s native token, AVAX, previously ranked among the top 10 largest cryptocurrencies in 2021 and currently stands as the 20th largest by market capitalization,” noted sources from CoinGecko, emphasizing the ongoing relevance of AVAX in the cryptocurrency market.

This marks the fourth instance of VanEck registering a standalone crypto asset ETF in Delaware, showcasing the firm’s proactive approach in the evolving financial landscape. Interestingly, VanEck’s efforts come as other players in the market, such as Grayscale, have also sought to convert existing funds to ETFs, hinting at a shifting dynamic in how digital assets are conceived as investment vehicles.

As the crypto landscape continues to evolve, the registration of the VanEck Avalanche ETF could pave the way for increased institutional engagement and accessibility for investors interested in the innovative world of decentralized finance and smart contract platforms.

VanEck’s Avalanche ETF Registration: Key Insights

The recent registration of VanEck’s Avalanche ETF in the U.S. is significant for investors and the cryptocurrency market. Here are the key points to consider:

- New ETF Registration:

VanEck registered the Avalanche ETF in Delaware, signaling its intent to offer a new investment vehicle focused on the AVAX token.

- Market Context:

The registration comes at a time when Avalanche (AVAX) has seen a 55% decline in value year-to-date, which could impact investor interest.

- Fourth Crypto ETF by VanEck:

This is VanEck’s fourth standalone cryptocurrency ETF registration, following Bitcoin (BTC), Ether (ETH), and Solana (SOL).

- Historical Significance:

VanEck has established itself as a pioneering player in the crypto ETF market, having filed for a futures Bitcoin ETF in 2017.

- Competitive Landscape:

Rival providers such as Grayscale have also shown interest in launching an AVAX ETF, indicating a highly competitive market.

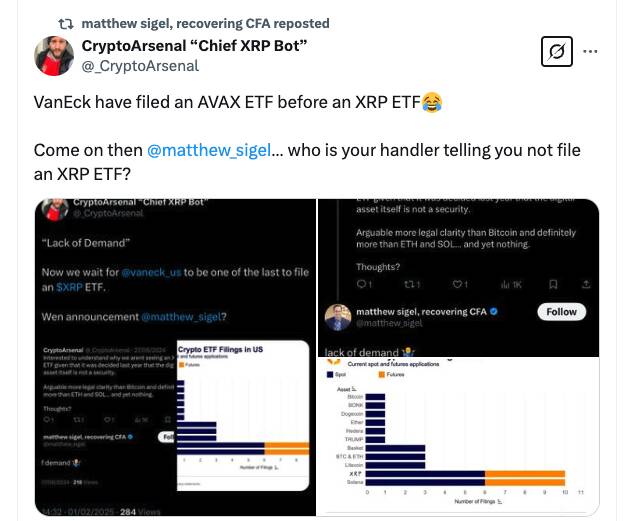

- Community Reaction:

Crypto community members are taking notice of the timing of the Avalanche ETF registration, expressing opinions about VanEck’s prioritization over other assets like XRP.

- AVAX Market Position:

Once a top 10 cryptocurrency, AVAX has dropped to the 20th position, emphasizing the volatility and risks in the crypto market.

These developments highlight significant trends and considerations for investors in the cryptocurrency space, potentially affecting decisions on asset allocation and risk management.

VanEck’s Avalanche ETF: A Strategic Move Amid Market Turbulence

The recent registration of VanEck’s Avalanche ETF in the United States could signal a transformative moment in the cryptocurrency investment landscape, especially as the market grapples with significant downturns. Despite the current challenges—Avalanche’s AVAX token has plummeted 55% year-to-date—this strategic filing highlights VanEck’s persistent ambition to capture market share within the ever-evolving crypto ETF sector.

Comparing VanEck with Competitors: VanEck is now a formidable player in the crypto ETF space, having embarked on ETF registrations for Bitcoin, Ether, and Solana prior to Avalanche. This positions them uniquely against other firms, such as Grayscale, which has also recently taken steps to convert its multi-coin fund into an ETF. While Grayscale’s approach may appeal to more risk-averse investors looking for broader exposure, VanEck’s dedicated Avalanche ETF could attract those eager to capitalize on specific altcoin movements. The clear differentiation is in focus: VanEck is banking on Avalanche’s potential despite its recent declines.

Potential Advantages and Disadvantages: VanEck’s decision to file for an AVAX ETF comes at a time when the cryptocurrency market remains volatile. This could instill confidence among investors who trust VanEck’s track record and expertise since they were one of the first movers in the futures Bitcoin ETF domain back in 2017. However, the timing may also pose challenges, as investors often hesitate to invest in assets that are experiencing major price drops. Balancing the speculative nature of cryptocurrencies with regulatory roadblocks remains a concern, and VanEck will need to address investor sentiments if they are to pivot successfully.

Who Stands to Benefit or Face Challenges?: The Avalanche ecosystem and its enthusiasts may find this move particularly advantageous, as increased institutional interest from major players like VanEck can boost AVAX’s visibility and credibility. Moreover, investors who have been holding AVAX might see this as a vote of confidence, potentially driving renewed interest in the asset. Conversely, this could create problems for competitors, particularly those slower to adapt to or acknowledge the potential of Avalanche. If VanEck’s ETF garners significant attention, rival offerings could face challenges in securing investment, especially if they are perceived as less innovative or responsive to market conditions. Overall, VanEck’s forward-thinking approach in a struggling market could redefine investor engagement with cryptocurrency ETFs.