In a significant development for the cryptocurrency landscape, asset manager VanEck has made headlines by seeking approval from US regulators to list an exchange-traded fund (ETF) that will hold BNB, the native token of Binance’s BNB Chain. According to regulatory filings, this proposed ETF is designed to acquire spot BNB tokens and may occasionally engage in staking these assets through trusted providers. This marks a historic moment as it is the first time an asset manager has filed for a BNB ETF in the United States.

The BNB token has become a noteworthy player in the cryptocurrency market, boasting a market capitalization of approximately $84 billion, as reported by CoinMarketCap. Currently, BNB stakers are enjoying a yield of about 2.5%, which adds to the token’s appeal for investors looking for income-generating opportunities. With nearly $6 billion in total value locked (TVL), Binance’s BNB Chain ranks among the most popular smart contract networks, highlighting its significant role in the broader DeFi ecosystem.

“This cycle so far has been the ETFs. And it’s almost all Bitcoin. Ether hasn’t had as much success but Bitcoin success will spill over to the others eventually,”

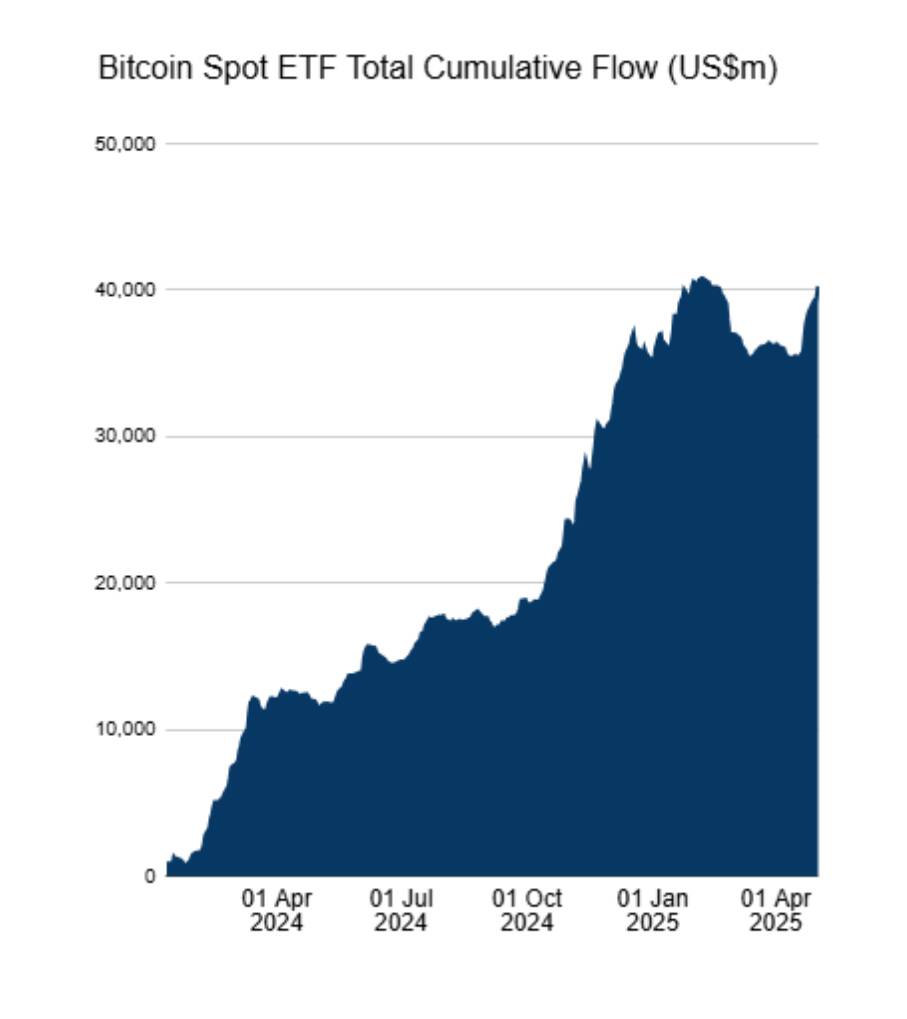

This filing comes on the heels of comments from Binance co-founder Changpeng “CZ” Zhao at the Token2049 conference in Dubai. Zhao anticipates that the ongoing excitement surrounding Bitcoin ETFs will extend to altcoins like BNB in due time. Since launching in January 2024, spot Bitcoin ETFs have attracted over $40 billion in net inflows, serving as a robust indicator of institutional interest in cryptocurrency investment.

VanEck’s latest filing is part of a broader trend, as several asset managers are now vying for approval to list ETFs holding a variety of altcoins, including prominent names like Solana and even memecoins such as Dogecoin. The U.S. Securities and Exchange Commission (SEC) has recognized a plethora of cryptocurrency ETF proposals in recent years, reflecting a rapidly evolving regulatory landscape that could shape the future of digital asset investments.

VanEck’s BNB ETF Filing: Key Points

The recent filing by asset manager VanEck to launch an ETF that includes BNB, the native token of Binance’s BNB Chain, presents several significant developments in the cryptocurrency space.

- First BNB ETF Filing in the U.S.

- This marks the inaugural filing for a BNB ETF by an asset manager in the United States, indicating a growing acceptance of cryptocurrency investment products.

- Market Capitalization of BNB

- BNB boasts a market capitalization of approximately $84 billion, highlighting its importance in the cryptocurrency market.

- Staking Yield Opportunities

- As of May 5, BNB stakers earn around 2.5%, which could attract investors looking for yield-generating assets.

- Popularity of BNB Chain

- With a total value locked (TVL) of nearly $6 billion, BNB Chain ranks among the most popular smart contract networks, which may influence its adoption and price stability.

- Impact of Bitcoin ETF Popularity

- Binance co-founder CZ predicts that the success of Bitcoin ETFs might spill over to altcoins like BNB, suggesting potential growth opportunities for investors in BNB and other cryptocurrencies.

- Flurry of ETF Proposals

- VanEck’s filing is part of a broader trend with multiple cryptocurrency ETFs being proposed, showing increased mainstream financial interest in digital assets.

“This cycle so far has been the ETFs. And it’s almost all Bitcoin. Ether hasn’t had as much success but Bitcoin success will spill over to the others eventually.” – CZ

These developments may impact readers by providing new investment opportunities in BNB and reinforcing the cryptocurrency sector’s evolution, potentially leading to increased interest and participation in digital assets.

VanEck’s Game-Changing BNB ETF Filing: A Comparative Analysis

VanEck’s recent move to file for an ETF that will hold Binance’s BNB tokens positions them at the forefront of the burgeoning altcoin ETF market. This filing could potentially redefine the landscape of cryptocurrency investments in the U.S., especially as it marks the pioneering attempt to create a BNB ETF. By aiming to accumulate spot BNB tokens and possibly staking them through trusted providers, VanEck is tapping into the growing interest in alternative staking opportunities, appealing to value-seeking investors.

In comparison to other recent ETF filings focusing on popular cryptocurrencies like Solana (SOL) and Avalanche (AVAX), VanEck’s BNB ETF carries unique competitive advantages and disadvantages. One major advantage is BNB’s impressive market capitalization of around $84 billion, demonstrating significant investor interest and liquidity. This sizable backing could provide stability and attract a broader investor base as they seek to diversify their portfolios beyond Bitcoin and Ethereum, whose respective ETFs have set a precedent for success.

However, the BNB token is not without risks. Binance has faced regulatory scrutiny in multiple jurisdictions, which may impact investor sentiment towards a BNB-based product. This volatility poses a disadvantage compared to ETFs linked to more established cryptocurrencies that enjoy regulatory clarity. Furthermore, VanEck’s past attempts to initiate other cryptocurrency ETFs have met with mixed results, signaling the possibility of ongoing challenges in gaining SEC approval that may affect timelines and investor confidence.

This news could significantly benefit retail and institutional investors looking for exposure to the ever-popular cryptocurrency market beyond Bitcoin and Ethereum. For investors already staked in the BNB ecosystem, this ETF could provide an easier path to liquidity and diversification. On the flip side, it may create complications for existing holders of BNB, as the introduction of an ETF could influence market dynamics and potentially lead to price fluctuations stemming from heightened trading activity.

In a rapidly evolving market where attention is increasingly focused on altcoins, VanEck’s BNB ETF may lead the charge in attracting new capital and interest toward lesser-known cryptocurrencies. As Binance’s co-founder CZ suggested, the success of Bitcoin ETFs might indeed create a spillover effect that amplifies the market for altcoin ETFs like VanEck’s BNB fund, although potential regulatory hurdles will require close monitoring from all stakeholders involved.