VanEck’s Onchain Economy ETF ($NODE) is poised to launch on May 14, 2025, offering a fresh investment avenue focused on companies that are driving blockchain technology adoption across various sectors. This actively managed exchange-traded fund seeks to capitalize on the ongoing digital transformation of the global economy by curating a portfolio of real-world enterprises essential to the burgeoning blockchain ecosystem.

With a management fee of 0.69%, $NODE aims to hold between 30 to 60 stocks selected from a pool of over 130 publicly traded companies involved in the digital asset landscape, including cryptocurrency exchanges, traditional financial institutions, and tech firms specializing in mining and blockchain infrastructure. Notably, up to 25% of its assets may be allocated to crypto-linked exchange-traded products (ETPs), offering some indirect exposure to digital assets while adhering to U.S. tax regulations.

“$NODE focuses on companies leveraging blockchain for real-world applications, instead of simply following cryptocurrency prices.”

The ETF distinguishes itself from traditional equity funds by investing exclusively in firms that either have blockchain at the heart of their business models or are integrating it into their future strategies. VanEck employs a meticulous selection process, which includes evaluating a company’s tangible progress in innovation and its market positioning within the blockchain landscape.

Moreover, to navigate market volatility, VanEck incorporates Bitcoin cycle metrics into its investment strategy. This method allows the ETF to optimize its risk exposure, responding dynamically to market sentiment and broader trends within the cryptocurrency ecosystem. As institutional interest in crypto-linked investments continues to rise, fueled by favorable regulatory shifts and a growing appetite for digital asset exposure, the timing of $NODE’s launch appears strategic.

“With institutional investors increasingly seeking regulated cryptocurrency options, $NODE positions itself to capture this escalating demand for crypto-equity exposure.”

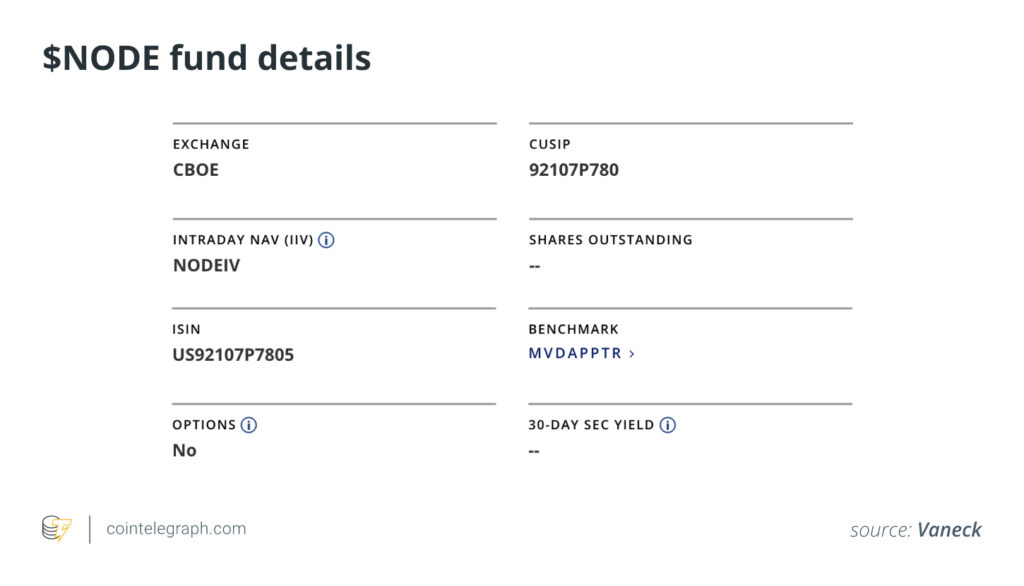

Investors interested in $NODE will need access to a brokerage account that offers trading on the Cboe BZX Exchange. While participating in this innovative fund, it’s essential to be informed about its structure, holding strategies, and the potential risks associated with the volatile nature of the cryptocurrency market.

Understanding VanEck’s Onchain Economy ETF ($NODE)

VanEck’s Onchain Economy ETF ($NODE) is an innovative investment option for those looking to engage with the blockchain evolution. Here are the key points regarding the ETF:

- ETF Launch and Trading:

- $NODE is set to begin trading on May 14, 2025, following its inception on May 13, 2025.

- This offers an opportunity to invest in blockchain-driving companies before they become mainstream.

- Active Management:

- The fund is actively managed, meaning selections are made by a portfolio manager based on analysis, rather than an algorithm.

- This could lead to potentially better returns compared to passively managed ETFs, especially in fast-changing markets like blockchain.

- Diversified Exposure:

- Invests in 30 to 60 stocks related to the blockchain ecosystem from over 130 companies.

- Direct exposure to sectors such as data centers, cryptocurrency exchanges, miners, and traditional financial institutions.

- Up to 25% of assets may be allocated to crypto-linked ETPs via a subsidiary, allowing for indirect digital asset exposure.

- Investment Strategy:

- The ETF focuses on companies leveraging blockchain technology for tangible business applications.

- Utilizes Bitcoin cycle metrics to adjust risk exposure, potentially enhancing investment performance.

- Long-Term Growth Potential:

- Investors can capture long-term growth from real-world blockchain integration across various industries.

- This aligns with macro trends indicating a shift towards digital assets, making it a timely investment.

- Key Risks:

- While the ETF itself doesn’t hold cryptocurrencies, market volatility and regulatory changes could still impact performance.

- Investors should understand the unique risks associated with the crypto ecosystem before investing.

- How to Invest:

- Investors need a brokerage account that provides access to the Cboe BZX Exchange to purchase $NODE.

- The trading process mirrors that of standard ETFs, making it accessible for mainstream investors.

Did you know? Crypto ETFs like $NODE allow you to invest in digital assets without managing cryptocurrencies directly, making them a more accessible option for traditional investors.

Exploring the Competitive Landscape of VanEck’s Onchain Economy ETF ($NODE)

VanEck’s Onchain Economy ETF ($NODE) positions itself uniquely within the burgeoning sector of blockchain-oriented financial products. Unlike many traditional ETFs that simply track stock market indices, $NODE’s actively managed approach specifically targets companies inspiring blockchain adoption and innovation. This focus can be seen as a competitive advantage, allowing the fund to navigate the ever-evolving landscape of digital assets while aligning with market trends. Moreover, the ETF’s structure—that includes a segment devoted to crypto-linked exchange-traded products (ETPs)—appeals to investors seeking a blend of equity exposure and indirect encryption investments within the regulatory framework of U.S. tax laws.

However, despite these advantages, $NODE faces a challenge inherent to its market: the cryptocurrency ecosystem tends to be notoriously volatile. While the ETF does not invest directly in cryptocurrencies, the performance of its holdings could still be influenced by price swings in digital assets like Bitcoin and Ethereum. This exposure creates potential drawbacks for conservative investors who may be wary of market fluctuations. Additionally, the ETF’s management fee—while competitive at 0.69%—is a critical factor to consider in the context of both passive and other actively managed funds, impacting overall returns over time.

The timing of $NODE’s launch coincides with an uptick in institutional interest in crypto-adjacent investments. This trend bodes well for the ETF as it taps into a growing demographic of financial advisors and asset managers actively seeking exposure to digital economy firms. The ETF could particularly benefit tech-savvy investors, millennials, and institutional entities who are more open to integrating blockchain technology into their portfolios. However, this environment also poses challenges for traditional institutions that may find it difficult to adapt quickly to the rapidly changing crypto landscape. For these players, $NODE represents both a potential ally as a diversified investment vehicle and a source of competition against traditional equity products.

In a broader context, as seen with the precedent set by the Purpose Bitcoin ETF launched in Canada, $NODE’s entry into the market could further catalyze the emergence of similar blockchain-focused investment products. This competitive surge has the potential to either elevate or complicate the positioning of VanEck’s offerings, depending on how other financial firms respond. Furthermore, with institutional confidence as indicated by massive Bitcoin treasury acquisitions, regulatory developments could either bolster or threaten the ETF’s growth, creating an ongoing balancing act for both investors and product managers alike.