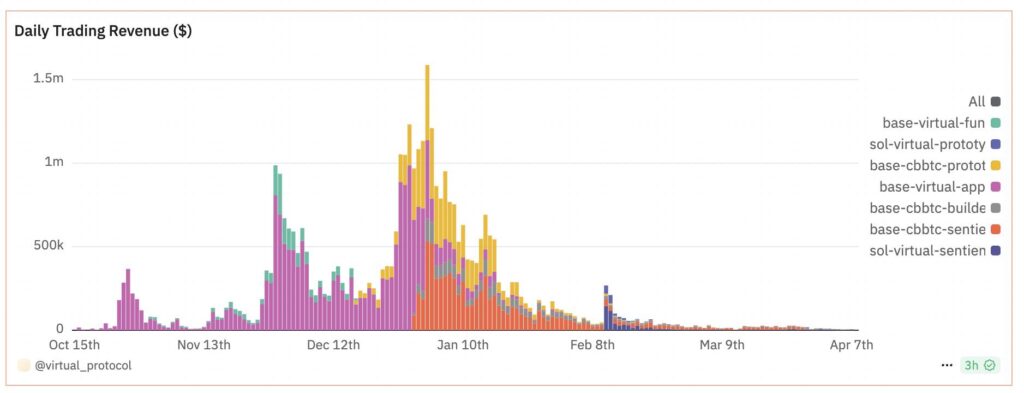

The cryptocurrency landscape is facing a seismic shift as the demand for AI agents seems to be dwindling, particularly for the Virtuals Protocol platform. Once a beacon of innovation within the crypto realm, Virtuals has now seen its daily revenue plummet to a mere $500, a staggering contrast to the over $500,000 it generated just months ago when its native token, VIRTUALS, reached an all-time high of $4.61 on January 2. Blockworks researcher Sharples characterized this decline as “one of the wildest crypto charts of the cycle.”

According to recent data from Dune Analytics, there has been a steep decline in the creation of AI agents on the platform. During its peak in late November, Virtuals was producing over 1,000 new agents daily. However, that momentum has virtually vanished, with no new AI agents launching in the past week, raising questions about the sustainability of this emerging sector.

“Probably one of the wildest crypto charts of the cycle,” – Sharples, Blockworks researcher.

As of April 7, the daily revenue of Virtuals stood alarmingly low at less than $500, while the price of its token plunged to as low as $0.42. This downturn is reflective of broader market conditions, as both the cryptocurrency market and global financial networks grapple with uncertainty amid rising tariffs and looming recession fears. The total market cap for AI agents currently sits at $153.81 million, yet a significant $76.6 million is anchored in AIXBT, a token focused on analyzing social media sentiments.

The community’s sentiments are mixed, with some experts questioning the practicality and functionality of current AI agents. AI commentator BitDuke succinctly stated that “ChatGPT wrappers are no longer interesting,” highlighting a growing skepticism towards these so-called AI solutions. While others remain optimistic, like Infinex founder Kain Warwick, who hinted at the potential for AI to make a comeback, he acknowledged that the initial iterations have left much to be desired.

As the Virtuals Protocol charts a bumpy road ahead, the crypto community watches closely, pondering whether it can regroup and redefine itself in a landscape fraught with challenges and competition.

Virtuals Protocol Revenue Decline and Its Implications

The recent decline in revenue for the Virtuals Protocol highlights significant trends in the crypto AI market that may impact investors and tech enthusiasts alike.

- Daily Revenue Drop: Virtuals Protocol’s daily revenue has plummeted to approximately $500, down from over $500,000 earlier in the year.

- Decline in AI Agent Creation: The number of new AI agents created has drastically decreased, from over 1,000 a day in late November to virtually none recently.

- Token Price Fall: The price of the Virtuals Protocol token dropped to $0.42 from its all-time high of $4.61 on January 2.

- Impact of Market Conditions: The downturn for Virtuals seems to correlate with broader trends in the crypto market and global economy, including political factors like tariffs instituted by US President Donald Trump.

- Criticism of AI Functionality: Many experts criticize current AI agents for their limited capabilities, suggesting that the interest in them may decline as a result.

- Overall Market Cap: The total market cap of AI agents stands at $153.81 million, with a significant portion tied to sentiment analysis tools like AIXBT, which has suffered a 92% decrease in value.

Decline in AI Agent Demand: A Look at Virtuals Protocol’s Struggles

The recent downturn in Virtuals Protocol’s revenues highlights a broader trend in the artificial intelligence and cryptocurrency space. After peaking in early January, when the AI agent creator was thriving, revenues have sharply dropped to just $500 daily. This staggering decline raises questions about consumer interest and market viability for platforms focusing on AI agents, especially within the cryptosphere.

Competitive Advantages and Disadvantages

While Virtuals once flourished alongside its broader category, its current struggles contrast sharply with competitors that may still be finding success through unique offerings or more favorable tokenomics. For instance, AIXBT, which specializes in crypto sentiment analysis on social media, holds a significant portion of the AI agent market cap. However, it, too, has faced a staggering 92% drop in value—suggesting that there is a systemic challenge across the board in maintaining investor enthusiasm.

Who Could Benefit? Who Could Struggle?

In the ever-evolving landscape of cryptocurrency and AI, those with robust strategies for adaptation may find opportunities. Investors looking at AI solutions that prioritize utility over mere novelty could benefit from platforms that focus on high-functionality offerings. The disparaging views on AI agents—likening them to “garbage”—could galvanize developers focused on authentic AI solutions that offer tangible benefits, leaving brands like Virtuals in the dust.