In a bold move aimed at revitalizing the Ethereum network, co-founder Vitalik Buterin has presented an ambitious proposal to replace the current Ethereum Virtual Machine (EVM) contract language with the innovative RISC-V instruction set architecture. This proposal, put forth on April 20, seeks to tackle long-standing challenges surrounding the network’s efficiency and scalability, crucial aspects as it faces stiff competition from next-generation blockchains like Solana and Sui.

Buterin’s proposal outlines significant bottlenecks within the Ethereum network, including issues related to data availability sampling and competitive block production. He asserts that adopting the RISC-V architecture could not only enhance performance but also foster a healthier competitive environment for block production. By incorporating this new architecture into smart contracts, the Ethereum network could potentially achieve efficiency gains of up to 100 times, according to Buterin.

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum, but for the execution layer to see similar gains, this kind of radical change may be the only viable path,”

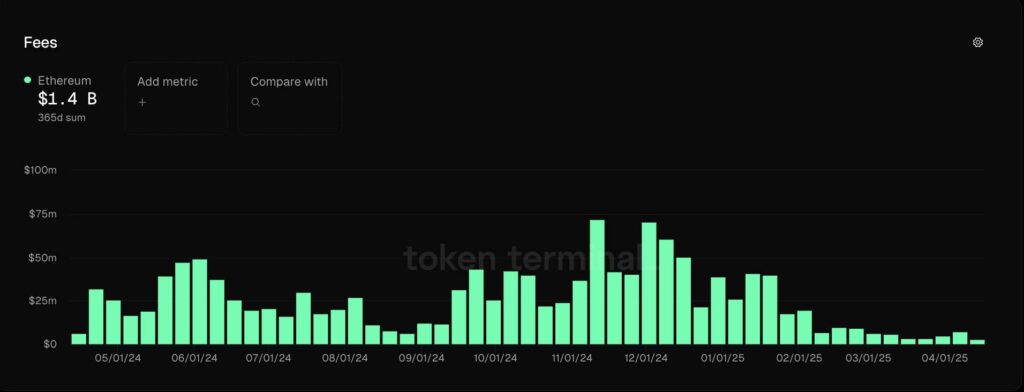

This ambitious pivot comes at a critical juncture for Ethereum, as a downturn in investor confidence has seen Ether’s price decline substantially. The April 2025 stats reveal network fees dropped to their lowest levels since 2020, averaging around just $0.16 per transaction. This dip, highlighted by Santiment’s marketing director Brian Quinlivan, underscores a trend where users are shifting towards layer-2 solutions instead of the Ethereum base layer, resulting in a significant decline in revenue for the core network.

This reliance on layer-2 solutions, while effective for reducing transaction costs, raises concerns about their impact on the Ethereum base layer’s financial health. The changing dynamics could further push Ether’s price to historic lows if confidence among investors continues to diminish. As the discussion around Ethereum’s sustainability and future unfolds, Buterin’s proposed changes may just be the catalyst needed to regain momentum in a rapidly evolving landscape.

Vitalik Buterin’s Proposal for EVM Improvement

Vitalik Buterin, the co-founder of Ethereum, has introduced a significant proposal aimed at enhancing the Ethereum network’s efficiency and speed. Below are the key points related to this proposal:

- RISC-V Proposal:

- Buterin suggests replacing the current Ethereum Virtual Machine (EVM) contract language with the RISC-V instruction set architecture.

- This change aims to improve the execution layer’s speed and efficiency.

- Long-term Bottlenecks:

- The proposal addresses several critical issues affecting Ethereum’s scalability, including stable data availability and block production competition.

- Zero-knowledge EVM proving is also an essential area for improvement highlighted by Buterin.

- Potential Efficiency Gains:

- Buterin estimates that the proposed changes could lead to efficiency gains of up to 100x.

- This increase could make Ethereum more competitive compared to newer blockchains like Solana and Sui.

- Market Confidence Concerns:

- Investors are increasingly losing confidence in Ethereum’s capabilities, as evidenced by the decline in Ether prices.

- The concerns regarding the revenue generation on the Ethereum base layer are heightened by the rise of layer-2 scaling solutions.

- Transaction Fee Dynamics:

- Ethereum’s layer-2 networks have significantly lowered transaction costs but at the expense of base layer revenue.

- Transaction fees on the base layer dropped to a nominal $0.16 per transaction as of April 2025.

- Future Price Predictions:

- If the current trend continues and investor confidence continues to dwindle, Ether prices could plummet to around $1,100.

“The beam chain effort holds great promise for greatly simplifying the consensus layer of Ethereum, but for the execution layer to see similar gains, this kind of radical change may be the only viable path.” – Vitalik Buterin

This proposal, if implemented, could have a profound impact on users and investors in Ethereum, potentially restoring confidence in the platform by enhancing its performance and competitiveness in a rapidly evolving blockchain landscape.

Vitalik Buterin’s Bold Proposal: A Game Changer for Ethereum’s Future?

In an intriguing shift for the Ethereum ecosystem, co-founder Vitalik Buterin has put forth a proposal to replace the Ethereum Virtual Machine (EVM) contract language with the RISC-V instruction set architecture. This move aims to tackle the current struggles related to speed, efficiency, and scalability within the network. While Ethereum has long been the flagship smart contract platform, it now finds itself competing against newer, faster contenders like Solana and Sui. The implications of Buterin’s proposal could spark both significant advantages and drawbacks for different stakeholders.

Competitive Advantages: By potentially increasing efficiency by up to 100 times, Buterin’s vision could rejuvenate investor confidence in the Ethereum network. Developers might find the RISC-V architecture more favorable for building and deploying applications, leading to a resurgence in innovations that leverage its capabilities. Such enhancements could not only speed up transactions but also reduce costs, making Ethereum more attractive to developers and businesses alike. Additionally, improvements in zero-knowledge functions could open doors for privacy-centric applications, attracting users focused on confidentiality in their transactions.

Competitive Disadvantages: However, this transformative proposal is not without its risks. Existing projects that rely heavily on the EVM may face disruptions, as they might need to incur the costs and complexities of adapting to the new architecture. Furthermore, if not executed flawlessly, Buterin’s ambitious plan could extend the timeline for achieving desired scalability, leaving Ethereum exposed to further degradation of its market position against swift alternative blockchains. The ongoing erosion of revenue from the base layer due to the rise of layer-2 solutions also raises concerns about the sustainability of Ethereum’s economic model.

This proposal could greatly benefit developers looking to maximize efficiency and scalability while creating new tools within the Ethereum ecosystem. Conversely, projects entrenched in the existing EVM architecture may encounter challenges as they strive to adapt. Investors and users alike will be watching closely; if confidence continues to erode, it could lead to a further price drop of Ether, worsening its prospects in the competitive blockchain landscape.