Volatility Shares is making headlines in the cryptocurrency world with the upcoming launch of two new exchange-traded funds (ETFs) focused on Solana (SOL). Scheduled for March 20, these ETFs, named the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), mark a significant moment as they become the first Solana-related ETFs available in the United States. This move comes on the heels of a broader shift in the regulatory landscape, with a change in leadership at the Securities and Exchange Commission fueling a surge in ETF applications.

The Volatility Shares Solana ETF (SOLZ) will initially carry a management fee of 0.95%, increasing to 1.15% after June 30, 2026. Meanwhile, the 2X Solana ETF (SOLT) promises double the leverage but comes with a higher management fee of 1.85%. These products aim to attract a wide range of investors seeking exposure to Solana, a blockchain platform known for its speed and cost-effectiveness in transactions.

“The implementation of SOL futures indicates that Solana is now recognized as a mature digital asset,” said Chris Chung, the founder of a Solana-based swap platform, highlighting how these developments could facilitate institutional interest in the cryptocurrency.

As the cryptocurrency market evolves, the arrival of these new Solana-focused financial products presents an opportunity for capital migration into the altcoin. Observers note that with the creation of these ETFs, Solana is being positioned for legitimacy in the world of real-world applications, distancing itself from the perception of being merely a speculative asset. The recent landscape changes, including potential approval of Bitcoin ETFs in 2024, have reignited a competitive spirit among cryptocurrencies, and Solana may well be at the forefront of this shift.

Launch of Solana Futures ETFs by Volatility Shares

The introduction of Volatility Shares’ Solana ETFs marks a significant development in the cryptocurrency market. Here are the key points to consider:

- Launch Dates and Details

- The Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT) will be launched on March 20.

- SOLZ will have an initial management fee of 0.95%, increasing to 1.15% after June 30, 2026.

- SOLT offers twice the leverage with a management fee of 1.85%.

- First of Its Kind

- These ETFs are the first Solana-based ETFs to be launched in the US market.

- The SEC filings occurred following the Chicago Mercantile Exchange’s launch of Solana futures contracts.

- Market Impact

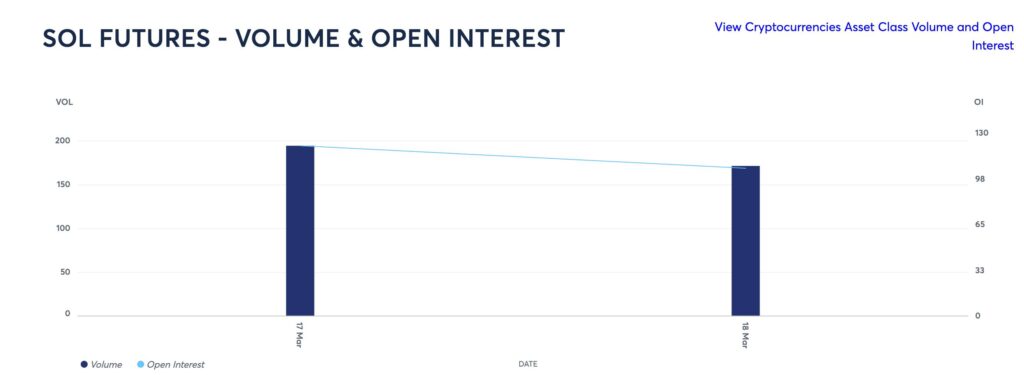

- On its first day, SOL futures achieved a trading volume of approximately .1 million.

- In comparison, Bitcoin and Ether futures had initial volumes of 2 million and million, respectively.

- Despite a lower trading volume, SOL futures indicate potential institutional interest which may lead to price discovery and increased demand for the cryptocurrency.

- Regulatory Changes

- Recent changes in leadership at the SEC have resulted in a wave of ETF applications for approval, reflecting a growing acceptance of digital assets.

- The approval of SOL ETFs signifies a policy shift towards embracing cryptocurrencies as legitimate investment products.

- Broader Implications for Investors

- The launch of these ETFs could facilitate capital inflow into Solana, potentially leading to sustained price appreciation.

- Investors may view SOL as a more established asset class, capable of real-world applications, beyond just speculative trading.

- These developments might cause a shift in capital allocation, particularly affecting altcoin dynamics and competition in the market.

“The CME’s futures indicate that SOL is now a mature asset capable of attracting institutional interest.” – Chris Chung, Founder of Titan

Comparative Analysis of Solana ETF Launch in the Crypto Landscape

Volatility Shares is making waves in the crypto investment arena with its upcoming launch of the Solana-based futures ETFs, SOLZ and SOLT. This move positions Volatility Shares at a distinctive advantage, especially considering it’s the first time Solana (SOL) ETFs are being introduced in the U.S. market. This cutting-edge initiative follows closely on the heels of the recent debut of SOL futures on the CME Group, which, despite starting with a modest trading volume, heralds a new era of institutional interest in Solana. The strategic timing of these launches aligns perfectly with a shift in regulatory attitudes towards digital assets, particularly following significant political changes.

However, the potential downside exists in the management fees associated with these products. The SOLZ ETF, with a management fee that initially stands at 0.95% but escalates to 1.15% post-June 2026, could be a deterrent for cost-sensitive investors. Meanwhile, the 2X leveraged SOLT comes in at a staggering 1.85%, serving as a double-edged sword. Although the promise of higher returns attracts those seeking amplified exposure to price movements, the high fee structure might alienate conservative investors who prefer lower management costs, especially when compared to more established products.

On a competitive front, the introduction of SOL ETFs signifies a critical opportunity for Volatility Shares to capture market share from both Bitcoin and Ether products that have already set benchmarks in terms of trading volumes. Unlike Solana, which is often seen as less traditional, Bitcoin ETFs enjoyed immense volume during their debut, overshadowing Solana’s promising yet tentative entry. This landscape creates a unique challenge for Solana’s NFTs, as they attempt to carve out their position without the robust initial investor commitments seen in the Bitcoin domain.

The launch of these ETFs stands to benefit a diverse group of stakeholders. Early adopters and institutional investors looking to diversify their portfolios with emerging assets could find a new avenue for growth. Furthermore, by offering leverage, the SOLT ETF could appeal to traders aiming to capitalize on short-term price fluctuations. On the flip side, the high fees and potential volatility linked with leveraged products might discourage more risk-averse investors. Additionally, this launch could pose competitive pressure on other altcoins that currently lack ETF offerings, as Solana users may experience a capital shift towards SOL, leaving competitors to vie for investor attention. As regulatory landscapes evolve, the success of Solana’s ETFs might also encourage further innovation in derivative products across the crypto space, potentially reshaping traditional market dynamics.