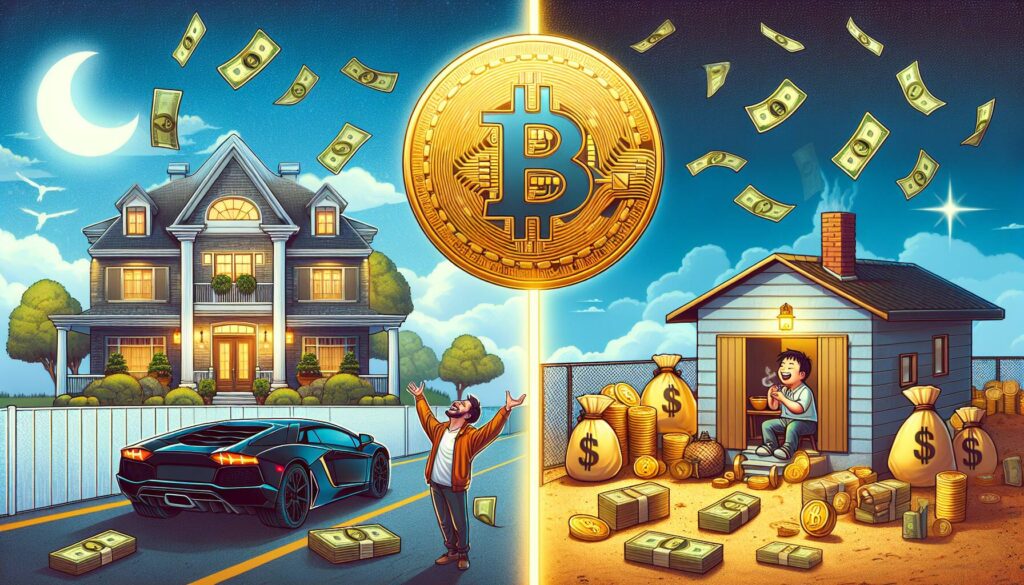

In a thought-provoking piece from Bitcoin Magazine, the discussion unfolds around the intriguing notion that owning just one Bitcoin could be more desirable than having a traditional millionaire status. This fresh perspective invites readers to rethink the value of digital assets in today’s economic climate. As Bitcoin continues to gain traction as a form of currency and an investment vehicle, this article explores the unique advantages that come with holding a whole Bitcoin.

In the world of finance, the allure of wealth often leads individuals to pursue millionaire status. However, this article asserts that the stability and potential growth of Bitcoin may outweigh the appeal of a large bank balance. The future of money is rapidly changing, and those who stake their claim in cryptocurrencies might find themselves on the cutting edge of a financial revolution.

“Owning one Bitcoin could signify a shift in how we perceive wealth, transforming our understanding of financial freedom in the digital age.”

By analyzing the implications of Bitcoin ownership, Bitcoin Magazine invites readers to envision a world where digital currencies redefine what it means to be affluent. With increasing institutional interest and broader public adoption, the conversation around Bitcoin is more relevant than ever. As cryptocurrency continues to reshape the economic landscape, this article serves as a compelling reminder of the potential power stored in a single Bitcoin.

Owning 1 Bitcoin Is Better Than Being a Millionaire

The concept of owning Bitcoin is increasingly viewed as superior to traditional wealth accumulation. Here are the key points that highlight this perspective:

- Scarcity of Bitcoin

- Bitcoin has a capped supply of 21 million coins, enhancing its value over time.

- The rarity of Bitcoin can lead to potential price appreciation, making it a more stable investment in the long term.

- Decentralization

- Bitcoin operates independently of any government or central authority, offering greater financial autonomy.

- This decentralization reduces risks associated with inflation and currency devaluation.

- Global Acceptance

- Bitcoin is increasingly accepted worldwide as a legitimate means of transaction and investment.

- As more businesses adopt Bitcoin, the value and utility of owning it are likely to increase.

- Potential for High Returns

- Historically, Bitcoin has shown significant price increases, with early adopters reaping substantial returns.

- Investing in Bitcoin can provide wealth-building opportunities that outperform traditional investments.

- Resilience Against Economic Downturns

- Bitcoin has demonstrated resilience during economic instability, acting as a hedge against systemic risks.

- This quality can provide peace of mind for investors looking for safe harbor investments.

Owning 1 Bitcoin might not just be an investment; it symbolizes entering a new financial paradigm where traditional wealth may be less meaningful than digital assets.

Why Owning 1 Bitcoin Could Be More Valuable Than Traditional Wealth

In a world where financial security often equates to having a million dollars in the bank, a compelling narrative has emerged from Bitcoin Magazine that shifts the focus towards the potential supremacy of owning 1 Bitcoin over conventional millionaire status. This perspective offers an intriguing take on the evolving landscape of value, drawing attention to the strengths and weaknesses of both scenarios.

On the one hand, the competitive advantage of possessing even a single Bitcoin lies in its scarcity and decentralized nature. While traditional wealth can fluctuate with market conditions and inflation, Bitcoin is positioned as a hedge against such volatility. The emotional connection individuals form with cryptocurrency, viewing it as a future currency rather than just an asset, can create a sense of belonging to a more innovative financial movement. Furthermore, the growing acceptance of Bitcoin as a legitimate payment method reinforces its value, positioning it as a futuristic financial tool.

However, this narrative does come with its challenges. The primary disadvantage is the inherent volatility of Bitcoin itself; its price can swing dramatically, leading to a degree of financial insecurity that typical millionaires might not experience. For investors more accustomed to the stability of traditional assets, this risk can be a deterrent. Additionally, the ongoing debates and uncertainty surrounding cryptocurrency regulations may create barriers to broader acceptance and usage, complicating the transaction landscape for Bitcoin holders.

This discussion is particularly beneficial for younger investors and tech-savvy individuals who are more inclined to embrace digital currencies. They are likely to find inspiration in the idea that owning 1 Bitcoin could symbolize not just wealth, but being part of an exclusive club of forward-thinking individuals. On the other hand, for traditional investors, especially those with a well-established portfolio, the focus on Bitcoin may create tension as they navigate between preserving their assets and adapting to new forms of investment.

In summary, while the allure of owning 1 Bitcoin as a paramount asset continues to gain traction, it poses distinct advantages and challenges. It’s a harbinger of change in financial paradigms, creating both opportunities for innovation and hurdles that must be navigated with caution.