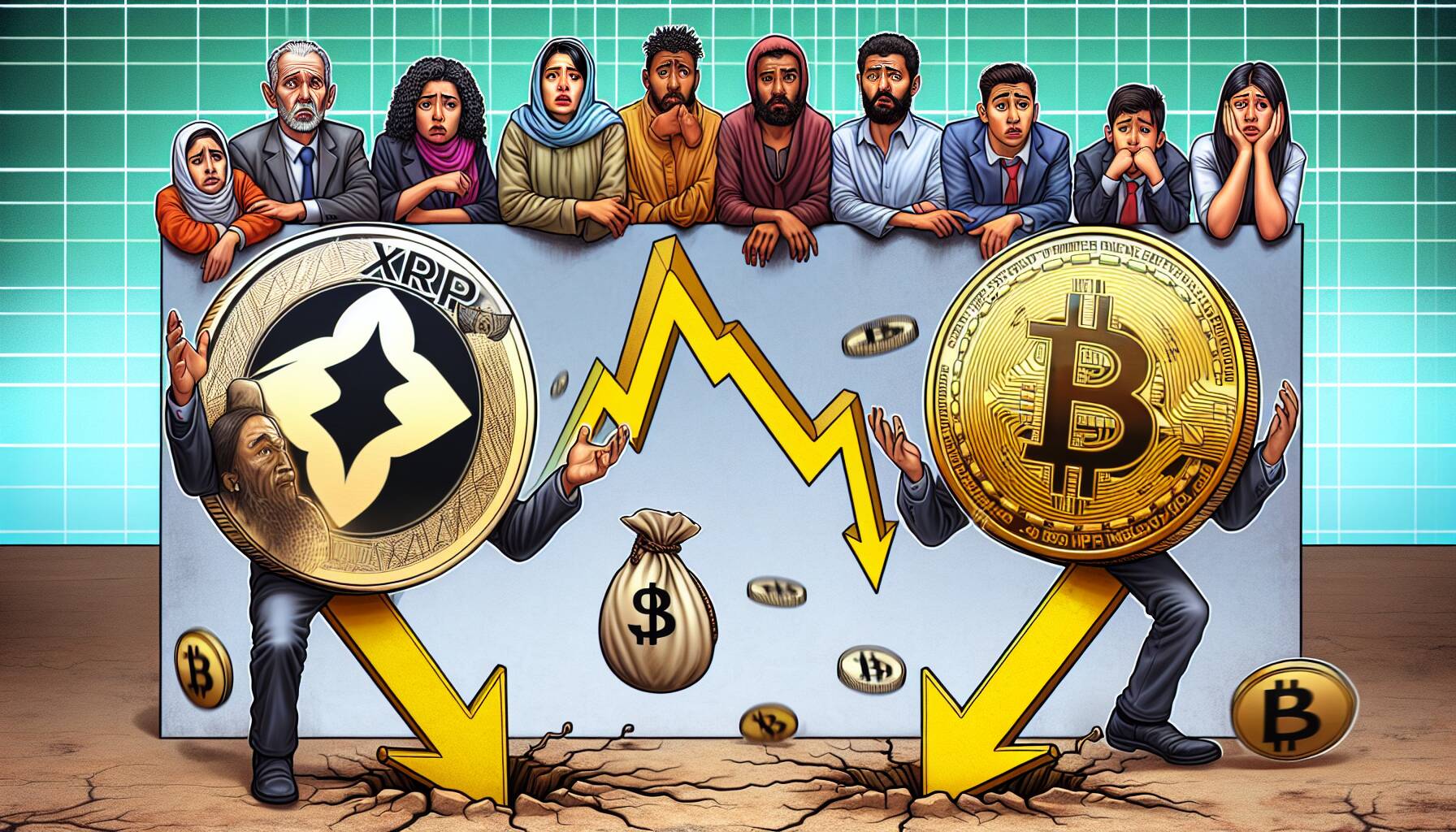

In a noteworthy turn of events, the cryptocurrency market is experiencing a downward trend as XRP and Bitcoin prices are both falling. This development has caught the attention of investors and crypto enthusiasts alike. Are these declines a cause for concern, or do they present potential opportunities for savvy traders?

As major players in the digital currency landscape, XRP and Bitcoin’s fluctuations often set the tone for the entire market. With Nasdaq reporting on this significant dip, many are left wondering if this is a temporary setback or a sign of deeper issues within the crypto realm.

“The current situation raises important questions for investors. Should they be worried about the sustainability of their investments, or is this just a natural part of the volatile crypto journey?”

As the market continues to evolve, keeping an eye on these trends has never been more crucial. The next few days could offer valuable insights for anyone involved in cryptocurrency trading or investing.

XRP and Bitcoin Market Trends

Key points regarding the falling trends of XRP and Bitcoin and their implications for investors:

- Current Market Decline: Both XRP and Bitcoin are experiencing a downward trend in value.

- Investor Sentiment: Concerns among investors may lead to increased volatility in the market.

- Market Reactions: Investors may reconsider their strategies and possibly shift towards safer assets.

- Long-term Implications: Sustained declines could impact the overall cryptocurrency market and investor confidence.

- Potential Buying Opportunities: Some investors view dips as a chance to buy at lower prices for future growth.

XRP and Bitcoin Decline: A Deep Dive into Market Implications

In recent market analyses, both XRP and Bitcoin have experienced notable declines, stirring a wave of apprehension among investors. This drop raises questions about the resilience of these major cryptocurrencies in the ever-evolving digital asset landscape.

Comparatively, similar news from competitors like CoinDesk and Bloomberg often highlights the volatility of crypto markets but tends to provide a more optimistic outlook, focusing on potential recovery patterns. One competitive advantage of these news sources lies in their extensive market analysis tools and expert opinions, which can offer better insights for risk-averse investors. Meanwhile, the critical tone in the Nasdaq report could deter less experienced investors who might be spooked by the negativity.

Institutional investors, for instance, could benefit from such stark revelations, as they may prompt a more cautious approach to their portfolios, ultimately leading to a stronger long-term strategy. However, retail investors might find the negative focus more challenging, as it could foster an environment of fear and uncertainty, leading to panic selling rather than informed decision-making.

Furthermore, the comparative landscape reveals a pivotal element: while Bitcoin traditionally holds the lion’s share of attention, XRP‘s recent legal battles and regulatory scrutiny compound its issues and make it a riskier investment choice in the current climate. This differentiation could favor Bitcoin in the eyes of cautious investors, while XRP might appeal to those with a higher risk tolerance who seek potential gains amidst volatility.