The cryptocurrency landscape continues to evolve as XRP and Solana take center stage, leading the charge in altcoin-based exchange-traded product (ETP) inflows during the week ending March 21. With inflows of .71 million and .44 million respectively, these two cryptocurrencies showcased significant market interest, according to data from the digital asset investment firm CoinShares. Comparatively, inflows for other altcoins, such as Polygon (MATIC) and Chainlink (LINK), were modest, bringing in only 0,000 and 0,000.

Overall sentiment in the altcoin market appears to be mixed at this time. Notably, Ethereum (ETH) witnessed substantial outflows, totaling million, dragging down the performance of many altcoins. Additional outflows were reported for Sui (SUI) at .3 million, Polkadot (DOT) also at .3 million, and Tron (TRX) with 0,000. Despite the struggles in the altcoin sector, digital assets still managed to break a five-week streak of net outflows, marking inflows of 4 million, largely thanks to Bitcoin (BTC) leading the recovery with a significant 4 million influx.

“Bitcoin recorded its largest net inflow since January, while Ethereum experienced net weekly outflows for four consecutive weeks.”

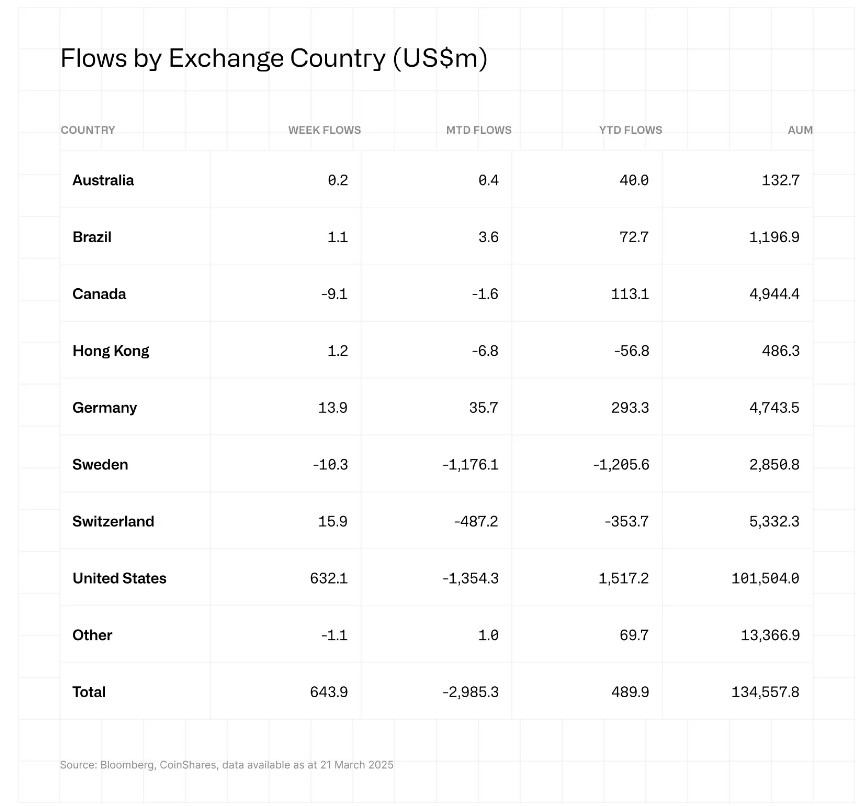

Much of the recent positive sentiment has originated from the US, which accounted for 2 million of the inflows, driven by investment vehicles like BlackRock’s iShares Bitcoin Trust (IBIT). Other countries like Switzerland, Germany, and Hong Kong also contributed, with inflows of .9 million, .9 million, and .2 million, respectively. In contrast, Canada and Sweden have seen notable outflows.

In the rapidly changing environment, Solana and XRP are currently positioned well. With the potential introduction of the first Solana futures ETPs in the US, there are high hopes for further market advancements, possibly paving the way for a spot Solana ETP. For XRP, the recent dismissal of the SEC’s long-standing lawsuit against Ripple Labs has provided a notable boost.

“Solana and XRP emerge as standout performers amid a turbulent market.”

As the regulatory landscape continues to shift, the future of cryptocurrencies remains full of potential. Investors and analysts alike are watching closely as the market adapts and evolves in response to these developments.

XRP and Solana Lead Altcoin ETP Inflows Amid Mixed Sentiment

The recent developments in the cryptocurrency market, particularly with XRP and Solana, have notable implications for investors and enthusiasts. Here are the key points from the latest data:

- XRP and Solana Saw Significant Inflows:

- XRP led inflows with .71 million.

- Solana followed closely with .44 million.

- Modest Inflows from Other Altcoins:

- Polygon (MATIC): 0,000

- Chainlink (LINK): 0,000

- Significant Outflows Seen in Ethereum:

- Ethereum (ETH) experienced million in outflows, impacting overall altcoin sentiment.

- Other notable outflows included Sui (SUI) and Polkadot (DOT), each at .3 million, and Tron (TRX) with 0,000.

- Overall Positive Trend for Digital Assets:

- Overall inflows for digital assets reached 4 million, reversing a five-week outflow trend.

- Bitcoin (BTC) was a major contributor, bringing in 4 million.

- Global Sentiment on Crypto ETPs:

- The US accounted for the majority of inflows at 2 million, largely driven by BlackRock’s iShares Bitcoin Trust (IBIT).

- Other countries also contributed significantly, with Switzerland leading at .9 million.

- Regulatory Environment Influencing Market:

- The first Solana futures ETF is expected to launch in the US, potentially leading to a spot ETF.

- The SEC’s handling of Bitcoin ETF applications has led to controversy, particularly regarding futures vs. spot ETFs.

- A recent lawsuit by Grayscale led to a review of the SEC’s positions, facilitating the movement towards potential spot Bitcoin ETF approvals.

- XRP’s Legal Battle Resolved:

- XRP benefited from the SEC’s dismissal of its lawsuit against Ripple Labs, enhancing its market position.

The developments in the cryptocurrency ETP market signify potential investment opportunities and risks, particularly with the growing emphasis on regulatory clarity and the performance of altcoins amidst significant market movements.

XRP and Solana Shine Amid Mixed Altcoin Sentiment

The latest data from CoinShares highlights an intriguing dynamic in the altcoin exchange-traded products (ETPs) landscape, with XRP and Solana taking the lead in inflows while Ethereum continues to struggle. This week marked a compelling uptick for XRP and Solana, which attracted .71 million and .44 million in investments, respectively. In contrast, the overall sentiment for altcoins appears mixed, primarily propelled by Ethereum’s hefty outflows of million, which significantly dampened the overall performance of the sector.

Competitive Advantages: XRP’s recent triumph stems from a favorable court ruling regarding its legal tussle with the SEC, fostering a wave of positive sentiment among investors. This regulatory clarity positions XRP advantageously compared to other high-cap altcoins facing uncertain futures. Solana, on the other hand, stands to gain from the impending launch of Solana futures ETFs in the US, which could bolster its market presence and drive further adoption. Both assets are now rising stars in a turbulent altcoin market, appealing to investors looking for potential high returns amid the ongoing volatility.

Disadvantages: However, the surrounding altcoin landscape shows vulnerabilities, especially with Ethereum’s performance pulling back the sector’s overall attractiveness. Investors might be wary of placing bets on altcoins given the broader sentiment shift marked by considerable outflows from Ether and its corresponding impact on other projects. Additionally, while Solana and XRP are gaining traction, the mixed sentiment towards altcoins as a whole could deter some cautious investors.

In this climate, who benefits? Clearly, institutional investors and more risk-tolerant retail investors with a keen interest in innovative financial products might find this an opportune moment. The entry of regulated futures for Solana could attract institutional capital looking for diversification beyond Bitcoin. Nevertheless, who might face difficulties? Traditional investors and those reliant on Ethereum for infrastructural stability may find the ongoing volatility and outflows problematic, complicating their investment strategies in digital assets.

Overall, while XRP and Solana are making strides, the shadow cast by Ethereum’s struggles suggests a need for cautious optimism among potential investors navigating this evolving landscape.