In the world of cryptocurrency, XRP has recently made headlines as it experiences a rollercoaster of price fluctuations. After reaching a towering peak of .39 in January, the digital asset saw a significant drop of nearly 30%, prompting investors to wonder about its future trajectory. Yet, despite this downturn, XRP has shown promising signs of recovery, partially fueled by optimistic news surrounding Ripple’s ongoing legal battle with the SEC and its new licensing achievements in Dubai.

As of March 24, XRP was trading at approximately .47, reflecting a remarkable 38% increase from its year-to-date low of .79. Observers are keenly analyzing its price movements, particularly as XRP appears to be climbing within a rising parallel channel, showcasing strength and hinting at a potential test of crucial resistance levels. Analysts highlight that a successful breakout above .59, a notable Fibonacci retracement level, may pave the way for further gains, targeting heights of around .77.

“The Relative Strength Index (RSI) is trending above 60, indicating building bullish momentum,” notes market analysts, which suggests the asset is not yet in overbought territory.

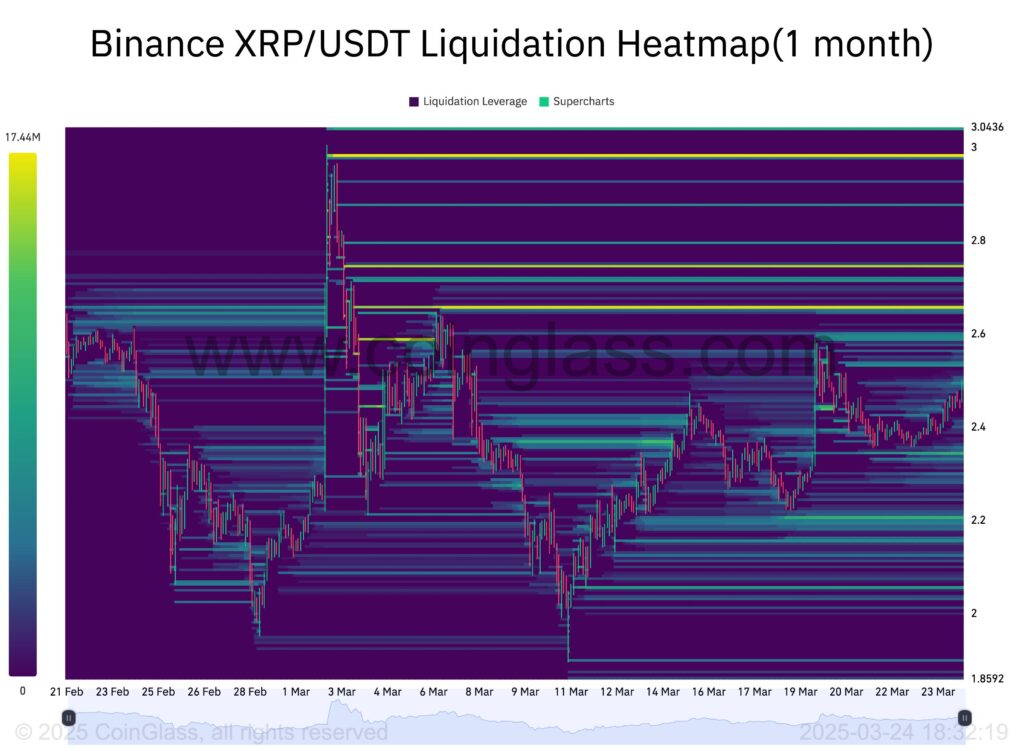

Moreover, XRP’s chart is currently forming a symmetrical triangle, a pattern that could foreshadow a breakout rally, particularly following a significant uptrend. Should this breakout occur, there are speculations that XRP could soar towards the .20 mark, offering an enticing prospect for traders watching closely. The volatility doesn’t stop there; liquidation heatmaps from various exchanges indicate that key levels around .66 could trigger significant market responses, potentially propelling XRP’s price ever higher.

As XRP captures the attention of both investors and analysts alike, the broader implications of its price movements and the legal developments involving Ripple are causing a stir in the cryptocurrency market, keeping the community abuzz with anticipation.

XRP Market Update: Key Points

The recent fluctuations and developments surrounding XRP could significantly impact investors and those interested in cryptocurrency. Here are the key takeaways:

- Price Drop and Recovery:

- XRP has dropped nearly 30% from a seven-year high of .39 in January.

- As of March 24, its price rebounded to .47, marking a 38% increase from its low of .79.

- Market Dynamics:

- Ripple’s potential resolution in the SEC lawsuit may bolster investor confidence.

- A new license in Dubai could enhance Ripple’s operational capacity and market presence.

- Technical Analysis:

- XRP is currently navigating a rising parallel channel, targeting .77.

- Testing support at .37 aligns with the 50-4H EMA, suggesting bullish momentum.

- A potential breakout above .59 (0.618 Fibonacci retracement) could lead to further advancements.

- Symmetrical Triangle Indicator:

- XRP shows signs of a bullish breakout from a symmetrical triangle, typically following uptrends.

- A successful breakout could see XRP rise to .20, approximating a 70% gain by May.

- Liquidity Zones:

- The liquidation heatmap highlights significant concentration near .66.

- A break above this level could trigger a squeeze, pushing prices towards .98.

Impact on Readers:

The fluctuating nature of XRP’s price, along with the potential legal and operational advancements, means that investors need to stay informed and vigilant to capitalize on possible opportunities while managing risks effectively.

Analyzing XRP’s Market Position Amidst Volatility

XRP has experienced a notable rollercoaster ride, dropping nearly 30% from its January peak yet recently showing signs of recovery. This volatility mirrors trends seen in other cryptocurrencies, particularly those bouncing back from regulatory uncertainty or significant legal challenges. For example, Ethereum’s recent struggles with scalability and regulatory scrutiny contrast sharply with XRP’s potential bullish movements as it navigates its ongoing SEC lawsuit. The prospects of Ripple finding a resolution might actually entice hesitant investors who have previously leaned towards Ethereum, providing XRP with a competitive edge.

One of the distinct advantages for XRP lies in its bullish news, particularly the anticipated resolution of its SEC lawsuit and a newfound license in Dubai, which bolster confidence and present a stark contrast to Ethereum’s ongoing scaling debates. While Ethereum’s transition to proof-of-stake aimed at improving performance and efficiency, XRP’s focused regulatory maneuvers and potential enhancements to its ecosystem could effectively lure investors seeking stability amidst uncertainty in market giants.

However, XRP faces its share of challenges. It’s essential to note that while bullish signals dominate XRP’s narrative, unforeseen regulatory developments could spark renewed fears, potentially halting its upward momentum. This illustrates the precarious balancing act between momentum and risk—particularly compared to more established coins like Bitcoin or Ethereum that have weathered numerous market dynamics over the years.

Investors looking to capitalize on the uptrend of XRP, especially those utilizing technical analysis, could benefit significantly from the projected price rebounds—especially if the .66 resistance level breaks, potentially triggering a price surge. Conversely, short sellers who have strategically placed their bets may find themselves in hot water if XRP manages to breach critical resistance barriers, leading to liquidity squeezes in the short term.

In summary, XRP’s current market positioning, bolstered by positive developments and technical breakout potential, juxtaposes favorably against other cryptocurrencies facing more entrenched challenges. However, its path forward is dependent on both internal developments and external market reactions, which could create lucrative opportunities or significant obstacles for engaged traders.