Over the weekend, XRP (XRP) marked a significant milestone in its performance against Ether (ETH), reaching its highest price ratio in five years. On March 15, the XRP/ETH trading pair peaked at 0.00128 ETH, a notable recovery from its all-time low of 0.00013 ETH recorded in June 2024, representing a remarkable rebound of approximately 925%. This comes after an increase of around 620% since November 2024, shortly after the U.S. presidential election.

The surge in the XRP/ETH ratio has prompted speculation that XRP could potentially overtake Ether to become the second-largest cryptocurrency by market cap. Analyst Dom emphasizes the historical significance of the 0.0012 ETH resistance level, a point that has often heralded substantial rallies for XRP in the past. When XRP has successfully breached this level, it has previously led to substantial price increases, with jumps of at least 160% noted after such breakouts in earlier years.

“XRP is presently retesting this crucial threshold, and if history is any guide, even a modest rally could allow XRP to surpass Ethereum in market capitalization,” Dom remarked.

As of March 16, XRP’s market capitalization stood at approximately 8 billion, trailing Ethereum by less than 0 billion. It’s noteworthy that XRP’s fully diluted valuation briefly outperformed Ethereum’s earlier in the week, highlighting an uptick in its market strength.

Several factors appear to be contributing to this shift in market dynamics. XRP has gained over 300% in market dominance since the re-election of Donald Trump on November 5, a period during which Ethereum has seen a decline of more than 35.50% in its share of the market. The regulatory landscape has shifted notably, with Trump’s administration positioning the U.S. as a future “crypto capital,” favoring XRP especially as Ripple has charted its institutional DeFi roadmap.

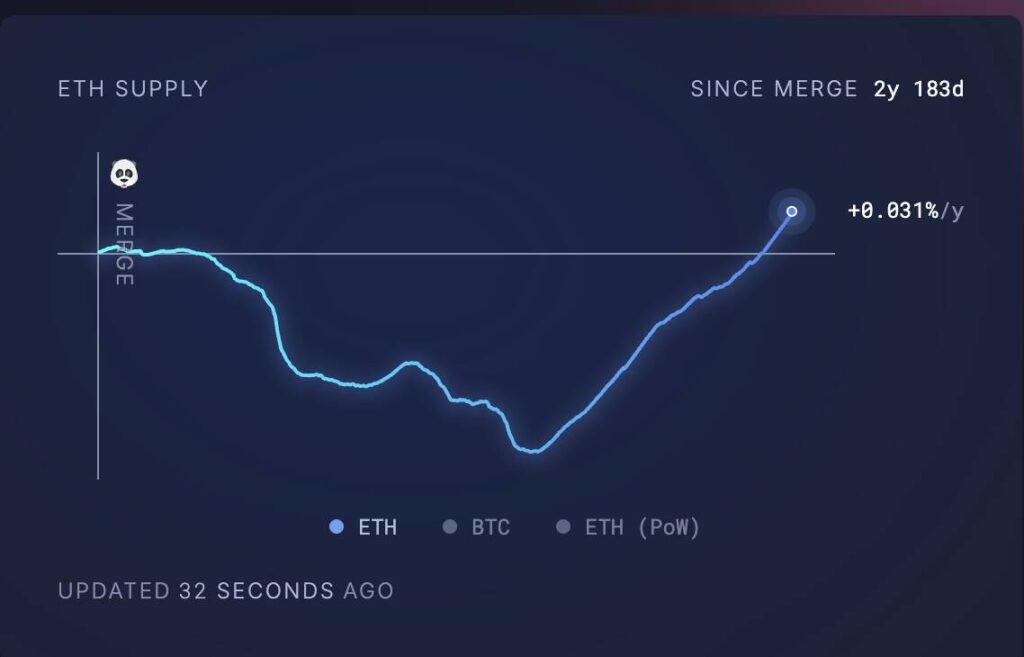

On the flip side, Ethereum has been facing increased competition from alternative layer-1 blockchains, particularly Solana (SOL), which has emerged as a strong contender in the decentralized finance (DeFi) space. Recent upgrades designed to enhance Ethereum’s scalability have inadvertently reduced its deflationary appeal, leading to concerns about an increased supply that may weaken its market position.

These developments paint a fascinating picture of the evolving cryptocurrency landscape, where XRP is not only recovering but also challenging the status quo held by Ethereum amid a backdrop of increasing competition and regulatory shifts.

XRP vs. Ether: A Five-Year High and Potential Market Shift

Over the weekend, XRP’s price in relation to Ether reached a significant milestone, which could have wide-ranging implications for the cryptocurrency market. Here are the key points to consider:

- XRP/ETH Price Surge:

- The XRP/ETH trading pair hit 0.00128 ETH, marking a 925% recovery from its all-time low of 0.00013 ETH in June 2024.

- This momentum showcases XRP’s potential for significant gains, especially following notable historical patterns.

- Analyst Speculations:

- Market watchers speculate that XRP could potentially surpass Ether to become the second-largest cryptocurrency by market cap.

- Investor sentiment is notably high due to critical resistance levels, with analysts pointing to 0.0012 ETH as pivotal for future price movements.

- Market Capitalization Insights:

- XRP’s market cap stands at 8 billion, nearing Ethereum’s, and has seen a significant growth of over 300% since recent political changes.

- XRP’s fully diluted valuation recently surpassed Ethereum’s, indicating heightened investor interest and potential undervaluation.

- Regulatory Environment:

- Regulatory sentiment under the new US administration favors cryptocurrencies, significantly benefiting XRP, as Ripple has launched a roadmap for institutional DeFi.

- This context may create a more favorable climate for enterprise use of XRP versus Ether’s growing challenges.

- Ethereum’s Market Struggles:

- Ethereum has seen a decline in market interest, losing over 35.50% of its market share while facing competition from efficient layer-1 solutions like Solana.

- Recent upgrades aimed at improving scalability and reducing fees may inadvertently increase Ethereum’s supply, diminishing its appeal as a deflationary asset.

This pivotal moment in XRP’s performance against Ether can impact investor decisions and market dynamics, especially as traders look for opportunities in a changing regulatory and competitive landscape.

XRP vs. ETH: An Intriguing Competitive Landscape

The recent surge in XRP’s price against Ether is creating quite the buzz in the cryptocurrency market. Having reached a five-year high over the weekend, the XRP/ETH pair’s performance draws attention not just due to its impressive rebound, but also because it exposes crucial dynamics in the crypto ecosystem. The stark contrast in market trends between XRP and ETH is noteworthy, suggesting potential shifts in investor sentiment and market positioning.

XRP’s Competitive Advantages are primarily a result of its regulatory landscape and its strategic pivot towards enterprise functionality. With the political climate in the U.S. seemingly favoring crypto ventures, particularly under Trump’s pro-crypto agenda, XRP has reaped significant benefits. The institutional DeFi roadmap unveiled by Ripple earlier this year has solidified XRP’s standing as a go-to for enterprise users. This proactive approach situates XRP favorably amidst growing regulatory clarity, boosting investor confidence and market capitalization.

In stark contrast, Ethereum faces several challenges that could hinder its performance. Despite implementing fee-reducing upgrades, ETH has struggled against increasing competition from other blockchain platforms like Solana, which offers lower transaction costs and greater scalability. As DeFi and NFT trading migrate to faster platforms, Ethereum’s traditional stronghold appears increasingly vulnerable. Additionally, Ethereum’s inability to maintain its “ultrasound money” narrative post-upgrade diminishes its attractiveness, leading to a marked decline in trader interest and market share.

Investors holding XRP stand to gain significantly from this shift. If the trend continues, those who back XRP could enjoy substantial returns as it moves closer to potentially overtaking Ethereum in market capitalization. This situation may prompt traders to reconsider their allocations, fostering a renewed interest in XRP as a viable investment.

However, the bearish sentiment around ETH could create problems for current ETH holders. With a dwindling market share and an increasingly competitive landscape, those who remain loyal to Ethereum may face pressure to reassess their positions. Should XRP maintain its bullish trajectory, ETH holders might find themselves at a crossroads, forced to either increase their liquidity by moving to more competitive assets or adjusting their strategies to navigate the shifting market dynamics.

In summary, the contrasting fortunes of XRP and ETH highlight the impact of regulatory landscapes and market competition on crypto investments. Investors should remain vigilant as these developments unfold, with XRP seeming poised for a strong upward trajectory while Ethereum grapples with a challenging market environment.