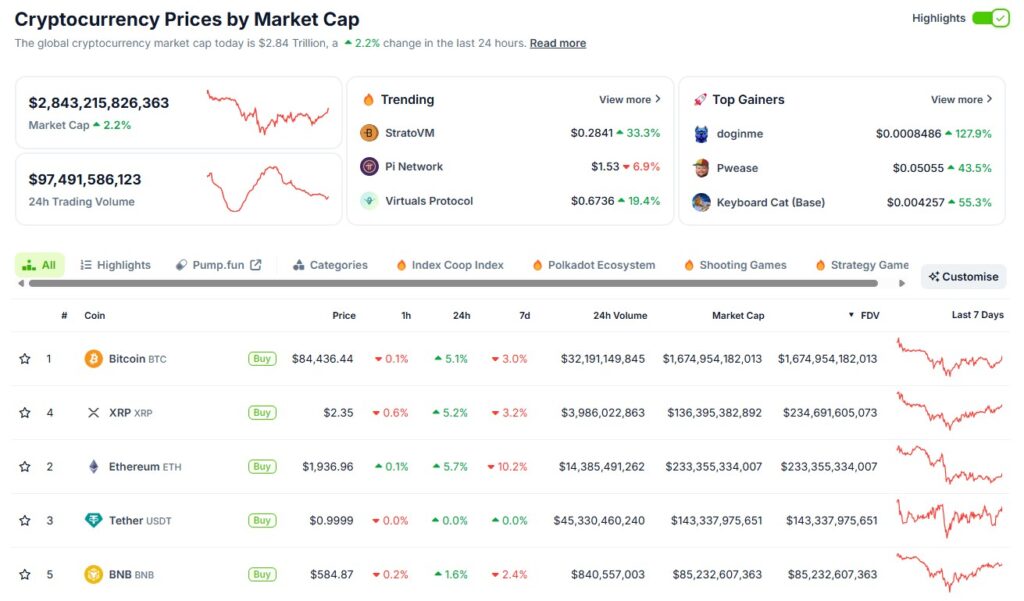

In a remarkable turn of events in the cryptocurrency landscape, XRP has outpaced Ether (ETH) in terms of fully diluted valuation (FDV), according to data from CoinGecko as of March 14. This noteworthy shift highlights an evolving dynamic between the two leading layer-1 blockchain networks, with XRP’s ecosystem experiencing a surge in decentralized finance (DeFi) activities while Ethereum faces increasing competition from other blockchain platforms like Solana.

On March 14, XRP’s FDV reached nearly 5 billion, edging out Ether’s by over billion, despite Ether maintaining a leading market capitalization of 3 billion compared to XRP’s 6 billion. The distinction between FDV, which factors in the total potential value of all existing tokens, and market capitalization, which reflects only circulating tokens, is essential for interpreting these figures.

“XRP’s significant price increase of over 300% since the U.S. elections reflects the changing regulatory landscape and renewed confidence in the cryptocurrency sector.”

Ripple Labs, the creator of XRP, holds a substantial allocation of its native tokens, indicating the company’s vested interest in the token’s success. The rise in XRP’s value coincided with President Donald Trump’s assertion that he envisions America becoming the “world’s crypto capital.” His administration has been characterized by appointing regulators who favor the growth of digital currencies, further benefiting XRP’s position.

In fact, Ripple’s decentralized exchange (DEX), which launched in early 2024, has already processed more than billion in swap transactions, signaling robust engagement within the XRP network. Furthermore, Trump’s proposal to include XRP, among other cryptocurrencies, in a U.S. Digital Asset Stockpile has contributed to the token’s growing popularity.

Conversely, Ether’s recent challenges stem from the Dencun upgrade, which took place in March 2024, slashing transaction fees by around 95%. This upgrade has put pressure on Ether’s spot price, while Solana’s trading volume is reported to rival that of Ethereum’s entire network, including all layer-2 solutions. As Ripple’s legal battles with the U.S. Securities and Exchange Commission (SEC) seem to be approaching a resolution, and with other notable crypto firms having recently seen actions dropped by the SEC, the changing tides in regulatory enforcement could play a pivotal role in shaping the future of both XRP and Ether.

XRP’s FDV Surpasses Ether: Implications for the Crypto Market

The recent data indicates a significant shift in the cryptocurrency landscape, with XRP’s fully diluted valuation (FDV) exceeding that of Ether. Here are the key points to consider:

- XRP’s FDV Reaches 5 Billion: As of March 14, XRP’s FDV surpassed Ether’s by more than billion.

- Market Capitalization Discrepancy: Ether’s market cap remains higher at 3 billion, compared to XRP’s 6 billion.

- Changing Dynamics in DeFi: XRP Ledger’s DeFi ecosystem is gaining traction, while Ethereum faces competition from other L1s like Solana.

- Impact of Regulatory Environment: A favorable regulatory landscape in the US under President Trump may benefit XRP significantly.

- Institutional Interest: Ripple Labs has introduced an institutional DeFi roadmap, enhancing the token’s attractiveness to enterprise users.

- XRP’s Price Surge: XRP’s price has risen over 300% since the 2024 US elections, reflecting growing investor confidence.

- US Digital Asset Stockpile: Trump’s plan to include XRP in a proposed stockpile could boost its legitimacy and usage.

- Competitive Landscape: Ether’s recent struggles, especially after the Dencun upgrade, highlight the competitive pressure from faster networks like Solana.

This shift in FDV and market dynamics may influence investors’ perceptions and decisions, as well as the future developments in the cryptocurrency ecosystem.

XRP Seizes Market Spotlight: A Competitive Edge Over Ether

In a surprising turn of events, XRP has eclipsed Ether in fully diluted valuation (FDV), highlighting a significant shift in the landscape of blockchain technology. This milestone, marked by 5 billion in FDV for XRP compared to Ether’s 4 billion, signals a newfound strength in XRP’s decentralized finance (DeFi) ecosystem while Ethereum faces mounting challenges from emerging competitors, particularly Solana. This competitive landscape suggests a dual narrative of opportunity and risk for both cryptocurrencies.

Advantages for XRP and Ripple Labs

XRP’s ascendance can largely be attributed to its strategic positioning in the market. The enthusiasm surrounding a friendlier regulatory environment in the U.S. has breathed new life into XRP, especially following statements from President Trump indicating his intent to establish America as a “crypto capital.” Ripple Labs’ clear focus on enterprise solutions resonates well within the corporate sector, making XRP an appealing option for institutional investors. Furthermore, with an established decentralized exchange (DEX) that has seen over billion in transaction volume since its inception, XRP has solidified its utility and credibility within the crypto space.

Challenges for Ethereum

Who Benefits, Who Faces Challenges?

The developments surrounding XRP can serve as a windfall for institutional investors and corporations interested in entering the crypto market, particularly those wanting to leverage regulatory clarity. Conversely, traditional Ether investors might be feeling the pressure as their asset loses ground not only in FDV but also in market sentiment amidst a climate ripe for repositioning. Moreover, Ethereum’s difficulties could create opportunities for Solana and other emerging platforms like Cardano, tempting investors to pivot in search of higher returns.

In the race to establish dominance in the blockchain ecosystem, XRP’s current trajectory presents significant advantages that could reshape investor preference and institutional strategy. Meanwhile, Ethereum must address its evolving challenges if it hopes to retain its longstanding market position.