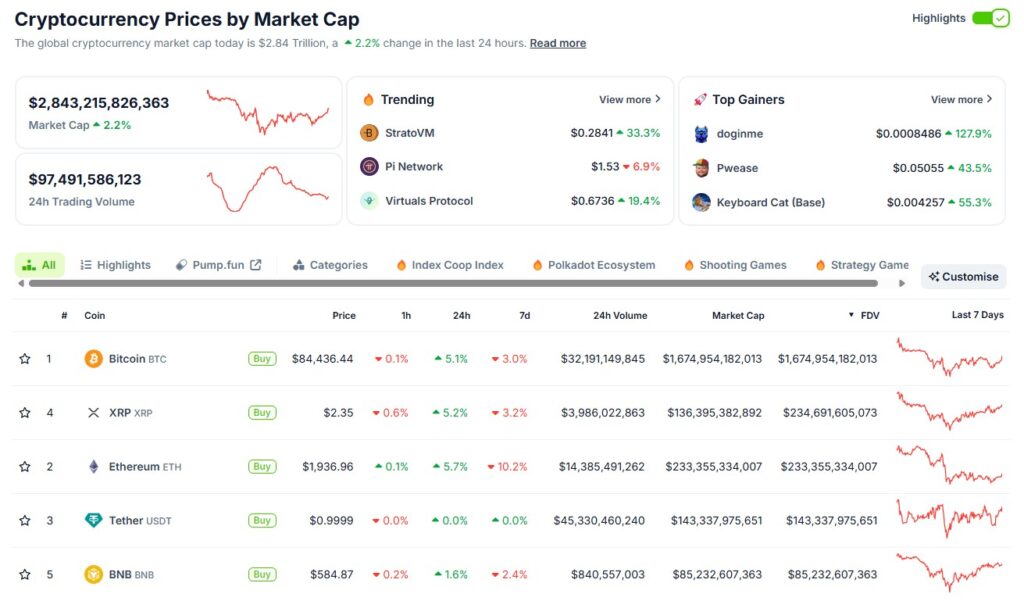

In a surprising turn of events for the cryptocurrency landscape, XRP’s fully diluted valuation (FDV) has surpassed that of Ethereum (ETH) according to data from CoinGecko on March 14. This milestone marks a noteworthy shift in the fortunes of the two leading layer-1 (L1) blockchain networks as factors such as the growing decentralized finance (DeFi) ecosystem on the XRP Ledger coincide with Ethereum’s struggles against stiff competition from rivals like Solana.

On March 14, XRP’s FDV reached nearly 5 billion, edging out Ether’s valuation by more than billion. However, it’s important to note that while XRP’s FDV is now higher, Ethereum still leads in market capitalization at 3 billion compared to XRP’s 6 billion. FDV accounts for the total potential worth of all tokens, while market capitalization focuses only on those currently in circulation.

Ripple Labs, the developer behind XRP, maintains a substantial stockpile of its native token, adding another layer of complexity to the valuation comparisons between the two assets.

XRP’s price has surged over 300% since the US presidential elections on November 5, 2024, when President Trump expressed his ambition for America to become the “world’s crypto capital.” This has created a favorable regulatory environment for XRP, which is particularly aimed at enterprise users. Ripple recently unveiled an institutional DeFi roadmap demonstrating its commitment to expanding its services.

Additionally, XRP’s decentralized exchange has already processed over billion in swaps since its launch in January. Hints of further support came when Trump indicated plans to incorporate XRP into a proposed US Digital Asset Stockpile, which would include assets seized through legal means.

On the regulatory front, the US Securities and Exchange Commission is reportedly nearing the conclusion of its long-standing enforcement action against Ripple, an issue that has loomed over the company since 2020.

In contrast, Ethereum’s spot price has been facing challenges, particularly following the Dencun upgrade in March 2024, which dramatically reduced transaction fees by about 95%. Meanwhile, Solana’s trading volume has surged, now rivaling Ethereum and its layer-2 solutions, fueled by its focus on rapid transaction capabilities and a notable presence in the 2024 memecoin frenzy.

This competitive atmosphere highlights the dynamic changes occurring within the cryptocurrency industry, where developments in regulations, technological upgrades, and market strategies continue to shape the trajectories of leading digital assets.

XRP’s Rise and Ethereum’s Challenges: Key Insights

Here are the most important aspects regarding XRP’s fully diluted valuation surpassing Ether, and how these developments might impact readers:

- XRP’s FDV surpassing Ether:

XRP’s fully diluted valuation (FDV) has exceeded Ether’s, reaching nearly 5 billion, indicating a significant shift in the blockchain landscape.

- Market Capitalization Differences:

Despite XRP’s FDV leading, Ether’s market capitalization remains at 3 billion, while XRP’s market cap is at 6 billion.

- Importance of FDV:

FDV considers the total potential value of all tokens, which may influence investment strategies for readers interested in long-term gains.

- Impact of US Regulatory Environment:

The changing regulatory landscape in the US, particularly favorable for XRP, could have implications for crypto market stability and enterprise use, affecting investment decisions.

- Institutional Interest:

Ripple Labs’ roadmap for institutional DeFi and the possibility of XRP being part of a US Digital Asset Stockpile highlights the growing acceptance of cryptocurrencies.

- Market Competition:

XRP’s rise comes as Ethereum faces competition not only from Solana but also from multiple L1 blockchains, which could affect confidence and investments in Ether.

- Transaction Fee Reduction:

The Dencun upgrade, which drastically reduced transaction fees for Ether, has not translated into higher trading volumes, raising questions about Ethereum’s competitive edge.

- Investor Sentiment:

Recent price surges and significant trading volumes via XRP’s decentralized exchange signal strong market sentiment and active engagement, potentially influencing readers’ investment decisions.

XRP Surpasses Ether in Fully Diluted Valuation: A New Era for Blockchain Competitors

The recent surge in XRP’s fully diluted valuation (FDV) to approximately 5 billion, overtaking Ether’s FDV, marks a significant shift in the blockchain landscape. This change not only highlights the growing strength of the XRP ecosystem but also raises eyebrows regarding Ethereum’s future in the competitive world of layer-1 (L1) networks. XRP’s impressive growth, driven by an expanding decentralized finance (DeFi) sector and a friendlier regulatory environment in the U.S., poses advantages and disadvantages for various market players.

Competitive Advantages: XRP’s leap in valuation can be attributed to several key factors. The backing of Ripple Labs, which maintains a considerable allocation of XRP tokens, offers a financial cushion that allows for confidence in the stability of XRP’s market presence. Furthermore, Ripple’s push toward institutional adoption and their recently unveiled DeFi roadmap positions XRP as a viable option for enterprise-level users. The favorable commentary from former President Trump regarding digital assets and the U.S. regulatory environment has further fueled investor enthusiasm, suggesting a long-term positive outlook for XRP.

On the other hand, Ether’s struggles post-Dencun upgrade, which drastically reduced transaction fees but led to declining spot prices, highlight the challenges it faces in retaining its users. As trading volumes on Solana and other agile L1s gain momentum, Ethereum’s dominance appears to be at risk. Investors and developers seeking lower transaction fees and quicker processing times may find Solana or XRP more appealing, potentially diverting interest from Ether.

Potential Beneficiaries and Challenges: The advancement of XRP is likely to benefit institutional investors looking for a stable and growing cryptocurrency backed by a reputable company and regulatory clarity. In contrast, these developments could spell trouble for Ethereum, whose market leaders might need to rethink their strategies to maintain relevance in an increasingly competitive environment. Additionally, projects like Solana, which boast fast transaction speeds and a rising profile, may siphon off users from Ethereum’s ecosystem, especially amidst Ethereum’s recent setbacks.

The evolving narrative surrounding these two leading blockchain networks illustrates a complex ecosystem where innovation, regulatory clarity, and user needs continuously shape the competitive landscape. XRP’s recent achievements could serve as a wake-up call for Ethereum’s developers, prompting them to accelerate innovation and improve user experience to retain their competitive edge.