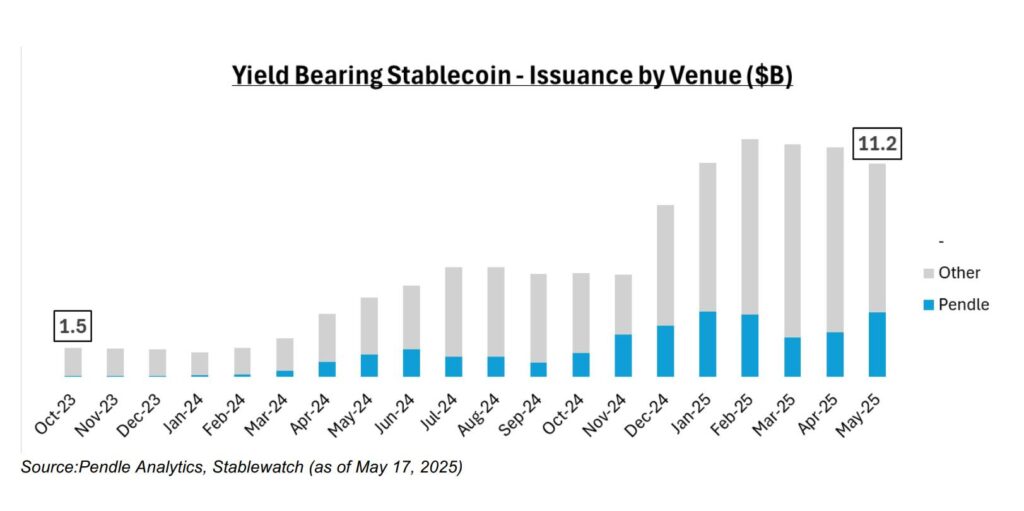

The cryptocurrency landscape is witnessing a significant transformation as yield-bearing stablecoins gain traction, currently boasting a circulation of $11 billion. This represents a notable increase from just $1.5 billion and a 1% market share at the start of 2024, climbing to 4.5% of the total stablecoin market. These innovative financial instruments are reshaping how investors approach stablecoins, with Pendle emerging as a frontrunner in this space.

Pendle, a decentralized protocol, has become a pivotal player, allowing users to lock in fixed yields or speculate on variable interest rates. According to a recent report shared with Cointelegraph, Pendle accounts for a remarkable 30% of all yield-bearing stablecoin total value locked (TVL), translating to approximately $3 billion. In an interesting shift, the proportion of stablecoins within Pendle’s overall TVL has jumped to 83%, compared to less than 20% just a year ago, while traditional assets like Ether (ETH) have diminished significantly.

As the cryptocurrency universe evolves, it’s essential to note that traditional stablecoins like USDt (USDT) and USDC do not provide interest returns to their holders. With over $200 billion in circulation and prevailing US Federal Reserve interest rates at 4.3%, Pendle estimates that stablecoin holders could potentially be missing out on more than $9 billion in annual yield.

“The rise in yield-bearing stablecoins comes amid increasing regulatory clarity under US President Donald Trump’s administration,” noted Pendle in their findings.

Recent regulatory developments have created a more favorable environment for yield-bearing stablecoins, as the US Securities and Exchange Commission has recognized these instruments as “certificates” subject to specific regulations. This change supports industry growth and ensures investor protections. Proposed bills like the STABLE and GENIUS initiatives indicate a positive trajectory for the sector.

Pendle anticipates that the issuance of stablecoins could reach $500 billion in the next 18 to 24 months, with yield-bearing variants expected to capture 15% of this burgeoning market, potentially translating to $75 billion in issuance—a staggering sevenfold increase from its current $11 billion. As the demand for yield-bearing strategies intensifies among both retail and institutional investors, Pendle is expanding its focus to serve as a critical infrastructure layer within decentralized finance yield markets.

In summary, as yield-bearing stablecoins continue to evolve and expand, Pendle’s innovative approach and strategic developments reflect a growing interest in maximizing returns within the crypto sphere. With new players entering the market and broader acceptance on the regulatory front, the future for yield-bearing stablecoins appears increasingly promising.

Exploring the Rise of Yield-Bearing Stablecoins

The surge in yield-bearing stablecoins marks a significant evolution in the cryptocurrency landscape, impacting investors and market dynamics. Here are the key points to consider:

- Market Growth:

- Yield-bearing stablecoins have increased to $11 billion in circulation, up from $1.5 billion, now holding a 4.5% market share.

- Pendle, a major player, accounts for 30% of this market, indicating a shift towards more lucrative stablecoin options.

- Missed Opportunities:

- Traditional stablecoins like USDT and USDC do not offer interest, causing holders to potentially miss out on over $9 billion in annual yield at current interest rates.

- Pendle estimates that holders of traditional stablecoins could significantly enhance their earnings by switching to yield-bearing options.

- Regulatory Developments:

- The SEC’s approval of yield-bearing stablecoins as securities introduces regulatory clarity, fostering growth in this market.

- Proposed legislative measures signal a supportive environment for stablecoin innovation and investor protection.

- Future Projections:

- Pendle anticipates the stablecoin market will double to $500 billion in the next 18-24 months, with yield-bearing stablecoins expecting to capture 15% of that market.

- This growth in issuance could lead to greater liquidity and investment opportunities in the yield-bearing stablecoin market.

- Technological Developments:

- Pendle is expanding its ecosystem by integrating with multiple blockchains and lending protocols, enhancing access to yield-generating strategies.

- There is a growing trend of decentralized finance (DeFi) platforms offering innovative ways to earn yield on digital assets, attracting both retail and institutional investors.

These developments indicate a potential shift in how investors approach stablecoins, favoring those that provide returns, thus impacting personal finance strategies and investment decisions moving forward.

Yield-Bearing Stablecoins: A New Frontier in Cryptocurrency

The surge of yield-bearing stablecoins to $11 billion in circulation marks a significant evolution in the cryptocurrency market, now capturing 4.5% of the total stablecoin space. This growth trajectory is underscored by the success of Pendle, a decentralized protocol that has cornered approximately 30% of the yield-bearing stablecoin total value locked (TVL), highlighting a shift in investor interest towards dynamic earning potentials. Unlike traditional stablecoins like USDt and USDC, which offer no interest to holders, Pendle’s innovative model introduces the opportunity for both fixed yields and speculation on variable interest rates. This competitive edge positions Pendle uniquely in an increasingly crowded market where investors are seeking maximum returns on their assets.

While Pendle has gained considerable traction, the landscape for yield-bearing stablecoins is evolving rapidly, creating challenges alongside opportunities. Major traditional players might face challenges as yield-bearing alternatives attract users seeking higher returns, potentially draining liquidity from established stablecoins. Additionally, with upcoming regulations under the Trump administration providing a framework for yield-bearing stablecoins, compliance demands could burden smaller, newer entrants in the market. The competitive advantage of regulatory clarity offers a favorable environment for growth, but it also raises barriers for these emerging players, posing a dual-edged sword.

The anticipated doubling of stablecoin issuance to $500 billion within the next 18 to 24 months will be pivotal. Pendle’s projection to capture 15% of this market, translating to $75 billion in issuance, presents significant opportunities for both retail and institutional investors. The growing interest in yield-generation strategies among these demographics further accentuates the potential of yield-bearing stablecoins to reshape financial strategies within both personal and corporate portfolios. Organizations looking to maximize their asset returns could find fertile ground here, albeit at the risk of instability as the market adjusts to the new dynamics.

As Pendle shifts its focus towards becoming a foundational layer for decentralized finance (DeFi), its plans to broaden support beyond Ethereum to include platforms like Solana will likely enhance its competitive standing. The increasing share of non-USDe assets in Pendle’s ecosystem reflects a diversifying interest, which could appeal to a wider audience. In contrast, traditional firms that are slow to adapt may struggle to retain clientele as innovative solutions emerge.

In essence, as the demand for yield-bearing assets grows, the implications for stakeholders are vast. Investors poised to leverage these advancements stand to gain substantially, but the evolving regulatory landscape and competitive pressures might create hurdles for those unprepared to adapt. While promising, the navigation of this burgeoning terrain will require astute strategies to capitalize on the emerging opportunities while mitigating potential risks.